Related Companies Reveals Renderings of Massive $12 Billion NYC Casino Complex at Hudson Yards

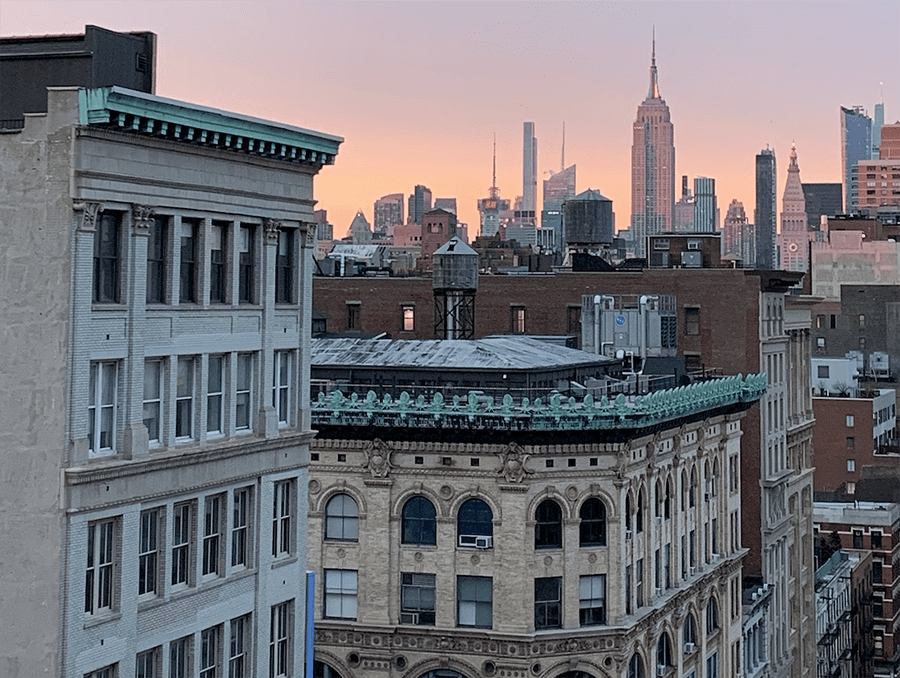

Plans have been revealed by Wynn Resorts for a colossal $12 billion project in Hudson Yards, a once train-filled area in Manhattan‘s West Side. The proposal, crafted in collaboration with real estate powerhouse Related Companies, envisions an imposing 80-story tower overlooking the Hudson River. This towering structure would house a sprawling gaming facility and hotel. Surrounding the magnificent casino skyscraper would be office complexes, residential towers, and an expansive 5.6-acre park, creating a vibrant urban landscape. Strategically positioned between West 30th Street and 33rd Streets, and 11th and 12th Avenues, the resort would be easily accessible to pedestrians strolling along the High Line, a repurposed elevated train line now serving as a public park. The architectural renderings depict a sleek office building and residential tower adjacent to the casino resort tower, enhancing the skyline from the Hudson River viewpoint. Additionally, the project includes plans for a 750-seat public school, a community facility, and a daycare center.

Dubbed Hudson Yards West, the venture, in collaboration with the Oxford Properties Group, promises to generate 35,000 union construction jobs and 5,000 permanent positions within the resort, according to its planners. Advocates for the proposal argue that the hotel component would become a prime destination for visitors attending events at the nearby Javits Center, potentially amplifying tourism and economic growth in New York City. Jeff Blau, CEO of Related Companies, remarked on the project’s potential to further invigorate the local economy, expressing enthusiasm for the development’s role in benefiting the state, the city, and the neighboring communities. Craig Billings, CEO of Wynn Resorts, highlighted the appeal of Wynn New York City as a premier destination for luxury travelers, citing the propensity of Wynn guests to spend more, thereby driving increased tax revenues and local economic activity. While the exact cost of the endeavor remains undisclosed, previous estimates suggest a staggering $12 billion investment, inclusive of expenses associated with constructing atop the rail yard. With the state contemplating the issuance of up to three casino licenses in the downstate region, intense competition among potential bidders has emerged. Notably, in Queens, Steve Cohen, owner of the New York Mets, has proposed an $8 billion gaming complex near Citi Field named “Metropolitan Park.”

Meanwhile, Resorts World New York City, situated at Aqueduct race track, has announced a $5 billion expansion, seeking approval to offer table games alongside its existing slot parlor. In the midst of this fervent competition, Hudson Yards’ developers face the challenge of securing political and community support, mindful of past opposition that thwarted similar projects, such as former Mayor Bloomberg’s proposed West Side Olympic stadium. State Sen. Brad Hoylman, representing the Hudson Yards neighborhood, has expressed the need to ensure alignment with the site’s original vision, dating back to 2009. The proposed development, with its consolidation of buildings and increased park space, must navigate a rigorous approval process involving city officials and undergo thorough land use review. Amidst skepticism from rival casino bidders, one close source remarks on the shifting prospects of the Hudson Yards plan, indicating a transition from a perceived impossibility to a challenging endeavor.

Source: New York Post

Images: Related Companies and Wynn Resorts