Iconic MetLife Building to Welcome Upscale Italian Eatery in Multi-Million Deal

In a move set to reshape Midtown Manhattan’s dining landscape, the team behind the successful La Pecora Bianca restaurant empire is expanding their culinary footprint with an ambitious new venture: Giulietta.

The hospitality group has inked a 15-year lease with Irvine Company for a sprawling 11,300-square-foot space at the base of the legendary MetLife Building at 200 Park Avenue. The deal marks one of the most significant restaurant leases in post-pandemic Manhattan, highlighting renewed confidence in the city’s commercial dining sector.

Giulietta isn’t just another Italian restaurant – it’s positioning itself as a dining destination, with plans for 250 indoor seats and an additional 200-seat outdoor area complete with a bar setup. The indoor-outdoor flow is designed to capitalize on the building’s prime location, offering diners a slice of Manhattan ambiance alongside their pasta.

“This is a statement about the future of New York City dining,” says a restaurant industry analyst who asked to remain anonymous. “When established restaurateurs make long-term commitments of this scale, it signals strong faith in the market’s recovery.”

The deal represents a strategic win for Irvine Company, which took full ownership of the 3.1-million-square-foot office tower in May. Roger DeWames, president of Irvine Company Office Properties, frames Giulietta as a crucial piece in the building’s evolving retail strategy. “Giulietta is the latest example of our continuous commitment to excellence,” he noted, suggesting it complements recent retail additions to the property.

The restaurant, slated to open in spring 2026, was brokered by hospitality specialist Friend of Chef representing the restaurant group, while CBRE – which conveniently headquarters in the same building – represented Irvine Company.

For food enthusiasts and Manhattan power lunchers alike, Giulietta’s arrival promises to add another compelling option to Midtown’s competitive dining scene. With La Pecora Bianca’s proven track record in delivering upscale Italian dining experiences, expectations are high for this new venture in one of New York’s most iconic commercial addresses.

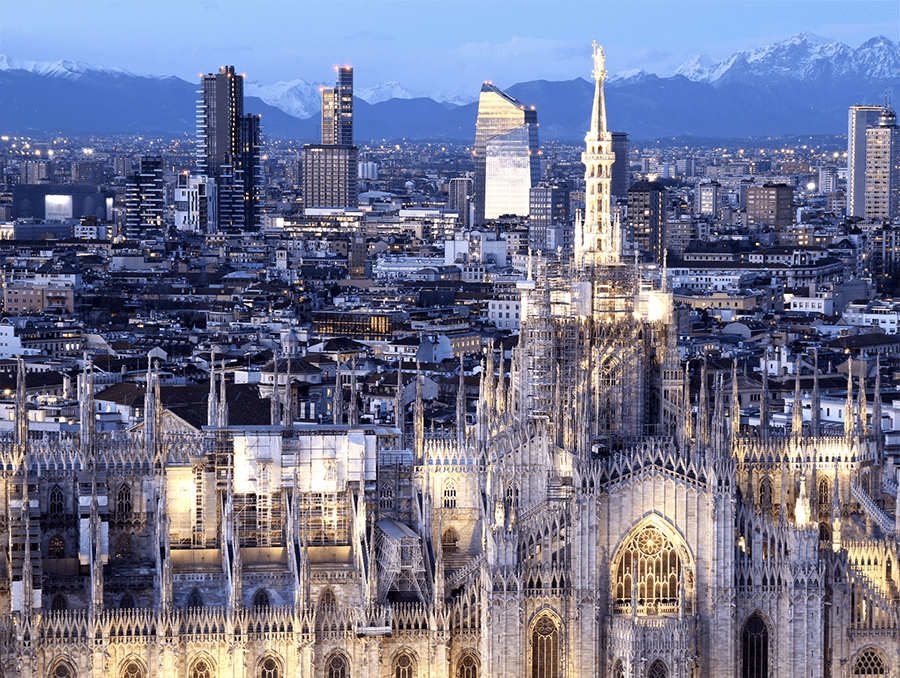

A photo of MetLife via Wikipedia | David Shankbone