Historic Tobacco Factory Reborn as Modern Residential Oasis in Florence

A new residential project called “Zenit” is coming to life in the area of the former Manifattura Tabacchi in Florence. Designed by the international architecture firm Quincoces Dragò & Partners, led by David Lopez and Fanny Bauer Grung, this project will transform the iconic entrance building of the Manifattura into 34 new residential units. Spanning an area of 4,800 square meters, with an additional 1,530 square meters of rooftop spaces, loggias and terraces, the project aims to preserve and enhance the original architecture, reinterpreting it in a contemporary and sustainable way.

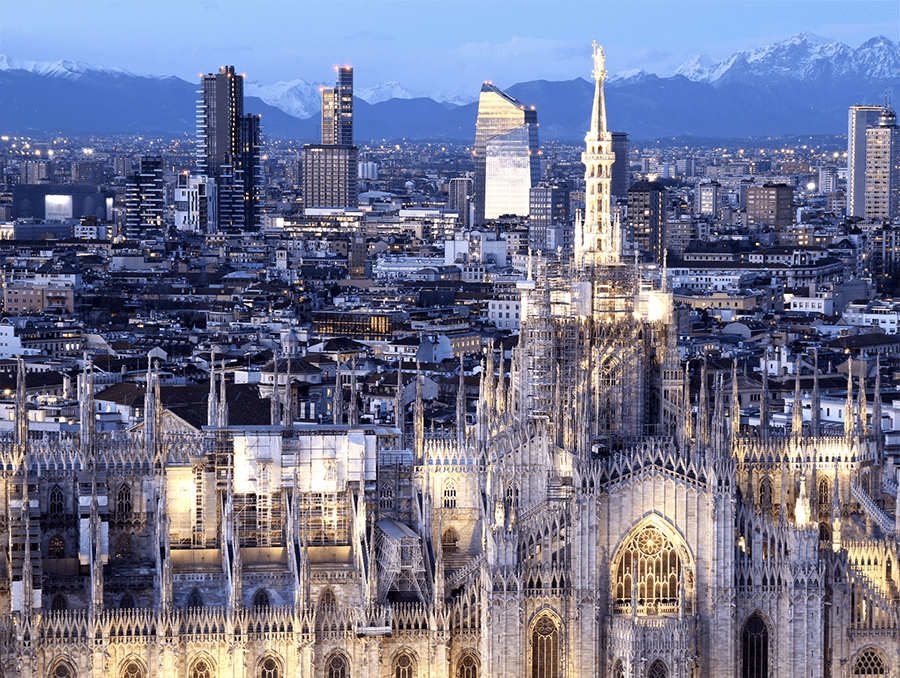

The architects have chosen to preserve the characteristic features of the building, such as the imposing volumes, exposed reinforced concrete structures, and large windows, while introducing modern and comfortable elements. Most of the apartments will feature private loggias and terraces, with privileged views of the restored industrial complex, the historic center of Florence, and the surrounding hills. The completion of the Zenit project is scheduled for March 2026. The new residences are already available for purchase in the experiential marketing suite located on the ground floor of Building 4 of the Manifattura Tabacchi (information is also available on www.liveinmanifattura.com), and the partnership with Savills has been renewed for the commercialization of the residential units. Zenit takes shape in the two wings of the entrance building of the Manifattura Tabacchi, which formerly housed the management, offices, and lodgings of the old factory.

Built between 1936 and 1940, the distinctively curved building features a monumental portal decorated with original bas-reliefs by the sculptor Francesco Coccia. This historical heritage becomes an integral part of the project’s identity, even in its name: Zenit was one of the cigarette brands produced at the Manifattura Tabacchi. The ground-floor apartments will be developed over two levels, taking advantage of the exceptional height of the original spaces to create a new mezzanine level. The living areas will extend outwards into cozy covered gardens or private terraces. The first-floor residences, arranged on a single level, will feature spacious private panoramic outdoor areas on the rooftop, accessible from the living area via a spiral staircase.

Zenit will enjoy privileged views of landmarks of the Manifattura Tabacchi’s regeneration, such as the Chimney Courtyard and Piazza Emanuela Loi, destined to host extensive green areas and cultural activities, as well as the skyline of Florence, the cultivated fields of the Agricultural Institute, the Cascine park, and the verdant hills. Future residents of Zenit will have access to numerous exclusive amenities, including a fitness room, a workshop equipped for bicycle maintenance, a pet room dedicated to the care of domestic animals, and a furnished condominium rooftop of approximately 400 square meters. Zenit is a candidate for achieving the Breeam Excellent environmental certification. All apartments, rated Class A1 or higher, will be equipped with state-of-the-art technological systems and rainwater recovery and recycling systems. Zenit follows the launch in 2022 of Anilla and Puro (a total of 45 units), currently in the final stages of construction in Buildings 7 and 12 and designed by Patricia Urquiola and the Florentine studio q-bic, respectively.

This project is part of the ambitious redevelopment plan promoted by the real estate company of the Cassa Depositi e Prestiti Group and Aermont Capital, with the coordination of MTDM – Manifattura Tabacchi Development Management Srl, which envisions the recovery of the historic industrial area by 2026, transforming it into commercial and office spaces, cultural and educational facilities, residential areas, hospitality, and public green spaces, totaling approximately 110,000 square meters.

According to Michelangelo Giombini, CEO of MTDM, “Manifattura Tabacchi is progressively transforming into a new, vibrant neighborhood that will be a protagonist in the social and economic life of Florence. Zenit is an important step in this journey, as it perfectly represents the synthesis of tradition and avant-garde design, promoting a high-quality lifestyle while prioritizing environmental and people’s well-being. Our goal is to create a sustainable and scalable model of urban regeneration, demonstrating that it is possible to develop by repurposing historic architecture – in this case, the factory built by Pier Luigi Nervi in the 1930s – choosing to preserve rather than demolish, enhancing green spaces, and offering the community of residents, professionals, students, and tourists a stimulating environment from an architectural, cultural, and professional standpoint.”

David Lopez Quincoces and Fanny Bauer Grung stated, “The project of recovering and transforming the former industrial spaces of the Manifattura Tabacchi is the result of a careful balance between preserving existing historical elements and introducing contemporary features that are functional for its new intended use. The meticulous attention paid to preserving the original elements, creating new spaces, and integrating modern technology reflects a comprehensive and thoughtful approach to renovation and design. The traces of the industrial past integrate with the new residences, as if seeking a kinship, a connection with the place. The old factories become an integral part of the new residences, a symbol of continuity and belonging to the territory. The result is a delicate balance between contemporary elements and highly historicized elements, a prudent choice aware of the context’s complexities.”

Source: Il Sole 24 Ore

Images: The Florentine and Manifattura Tabacchi