Kim Kardashian’s Skims Scores Prime Fifth Avenue Retail Space at Bargain Rates (The Real Deal)

In a strategic move that underscores shifting dynamics in New York City’s retail real estate landscape, Kim Kardashian‘s apparel empire, Skims Body, has secured a coveted lease for a sprawling 20,000-square-foot space on Fifth Avenue. This development comes at a fraction of the cost compared to its predecessor, signaling a savvy business maneuver amidst a changing market. According to reports from The Real Deal and Crain’s, Skims Body inked a deal with Oxford Properties and Crown Acquisitions for at least 75 percent below the previous tenant’s lease rates. The stark difference in pricing was highlighted in a recent report by Fitch Ratings, which also noted adjustments in the mortgage structure backing the Skims space and other properties in the vicinity. While specific lease details remain undisclosed, industry experts speculate that Skims Body’s rental rates could be well below the $770 per square foot paid by Versace, the former occupant, as reported by KBRA in 2022.

This suggests that Skims Body is likely paying under $200 per square foot—a substantial reduction reflective of evolving market dynamics. Kim Kardashian’s multifaceted entrepreneurial prowess likely played a pivotal role in securing such advantageous terms, especially as neighboring retailers recalibrate their strategies and vacate Fifth Avenue addresses. This vacancy trend has empowered companies like Skims Body to negotiate from a position of strength, capitalizing on prime retail spaces in iconic locales. Oxford Properties reports full occupancy for Olympic Tower’s retail segment, constituting 28 percent of the property but contributing over 60 percent of total rental revenue. Negotiations are also underway for office space within the same complex, showcasing sustained investor interest despite recent market adjustments. Institutional investors, who have held the mortgage since 2017, recently witnessed Fitch downgrading seven classes associated with the $760 million loan, due for maturity in 2027. The transition in tenant occupancy has coincided with a 13 percent dip in cash flow, now at $56 million annually, since the mortgage’s initial sale. Skims Body is gearing up for a grand opening slated for February, enhancing its brand presence with a high-profile physical retail outlet.

The company’s meteoric rise is mirrored in its valuation, which surged to $4 billion last year—a staggering $800 million leap from 2022 figures. Versace’s gradual exit from the space since 2018, initially signaled by its subleasing efforts, underscores the dynamic shifts reshaping New York’s retail real estate narrative. As Kim Kardashian’s entrepreneurial ventures continue to make waves across industries, Skims Body’s strategic real estate play exemplifies a nuanced understanding of market opportunities amid evolving consumer preferences and economic landscapes. This move not only solidifies the brand’s physical footprint but also underscores the enduring allure of iconic retail addresses amidst transformative market forces.

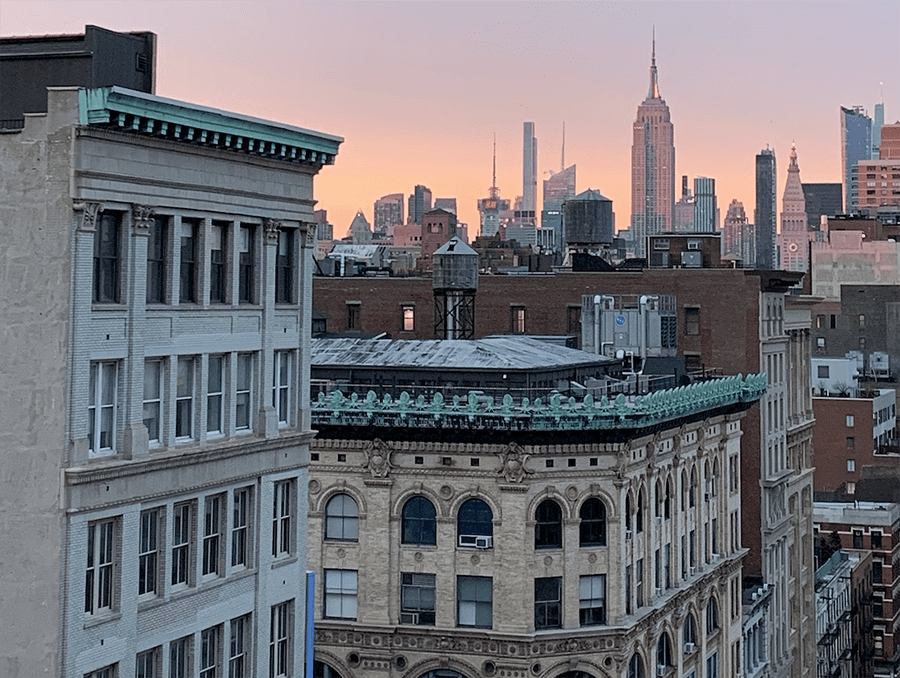

Photo credit: Skims