Miami’s Real Estate Transformation: Million-Dollar Mansions Rise as Affordable Homes Vanish

Miami’s skyline isn’t the only thing reaching new heights. As ultra-wealthy buyers flood the South Florida market, they’re reshaping the entire real estate landscape, creating a city where luxury properties abound while entry-level homes become relics of the past.

The Vanishing Starter Home

As per The Wall Street Journal, the statistics tell a startling story. Between 2019 and 2024, single-family homes priced below $500,000 in Miami-Dade County have plummeted by an astonishing 79.6%, according to research firm Analytics Miami. This dramatic shift coincides with hedge-fund titan Ken Griffin’s historic $100 million home purchase—the first of its kind in Miami—which seemingly opened the floodgates for similar high-end transactions.

The data reveals the complete transformation of Miami’s housing market. What was once a city with diverse housing options has rapidly evolved into a playground for the ultra-wealthy, with profound implications for everyone else.

The Griffin Effect

Griffin’s record-breaking purchase wasn’t just a headline—it was a harbinger. Since that landmark transaction, Miami has experienced an unprecedented surge in eight and nine-figure home sales, reshaping market expectations and pricing strategies throughout the region.

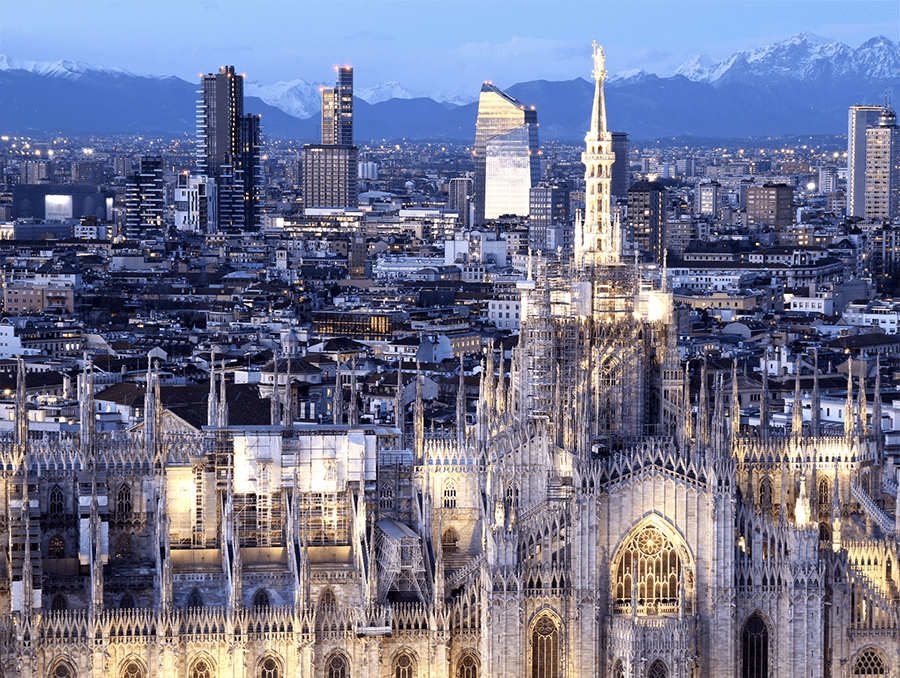

Griffin’s statement purchase validates Miami as a true luxury destination on par with New York, London, and Hong Kong. This landmark transaction has influenced other wealthy individuals to see Miami differently—not just as a vacation spot but as a place to establish a significant presence.

The trend has accelerated further with Russian billionaire Vladislav Doronin’s recent sale of his Star Island estate for a staggering $120 million—setting a new record for Miami-Dade County. The property, which Doronin purchased from retired NBA star Shaquille O’Neal for $16 million in 2009, represents a remarkable 650% return on investment. According to reports from The Real Deal and the South Florida Business Journal, the luxurious residence is rumored to be a teardown purchase, signaling that even trophy properties may be viewed as merely land acquisitions in today’s ultra-luxury market.

Economic Ripple Effects

This transformation extends far beyond real estate statistics. As affordable inventory disappears, Miami’s workforce—the teachers, healthcare workers, and service industry employees who keep the city functioning—face increasingly untenable housing situations.

Average earners now commute from ever-distant suburbs, with some traveling more than 90 minutes each way to reach jobs in Miami’s core. This migration creates additional pressure on transportation infrastructure while simultaneously altering the demographic makeup of Florida’s most dynamic city.

There’s a real risk of Miami becoming a tale of two cities—one populated by the ultra-wealthy and the other by those who serve them, with very little in between. The ongoing middle-class exodus threatens the diversity and vibrancy that made Miami special in the first place.

Investment Drivers

Several factors fuel this market transformation. Florida’s favorable tax environment, combined with Miami’s international appeal and lifestyle amenities, creates perfect conditions for wealth migration. The pandemic accelerated these trends, as remote work capabilities allowed executives from high-tax states to relocate permanently.

Miami offers what wealthy individuals from New York, California, and international locations seek: financial advantages, cultural dynamism, and extraordinary quality of life. This isn’t a temporary trend—it’s a fundamental realignment of where capital and influence concentrate in America.

The New Normal?

Industry experts debate whether this market shift represents a permanent change or a cyclical extreme. Some point to similar patterns in cities like San Francisco and New York, suggesting Miami will eventually reach a new equilibrium that accommodates diverse income levels.

Others see Miami’s transformation as more profound and potentially irreversible. The combination of limited developable land, strong international demand, and climate-related challenges to new construction creates unique pressures that may permanently alter the city’s housing ecosystem.

The $500,000 single-family home in Miami-Dade isn’t just endangered—it’s practically extinct. Looking ahead, the market will need to completely rethink how housing functions in this region, because the old paradigms simply no longer apply.

For now, the city continues its remarkable metamorphosis, with each eight-figure transaction further cementing Miami’s status as America’s newest ultra-luxury real estate capital—and pushing the prospect of affordable homeownership further beyond reach for everyone else.

This article represents analysis based on current market conditions and expert opinions. Real estate investments involve risk, and market conditions may change.

For inquiries regarding distinguished Miami properties—whether for acquisition or divestment—the esteemed real estate professionals at Columbus International remain at your service. info@columbusintl.com