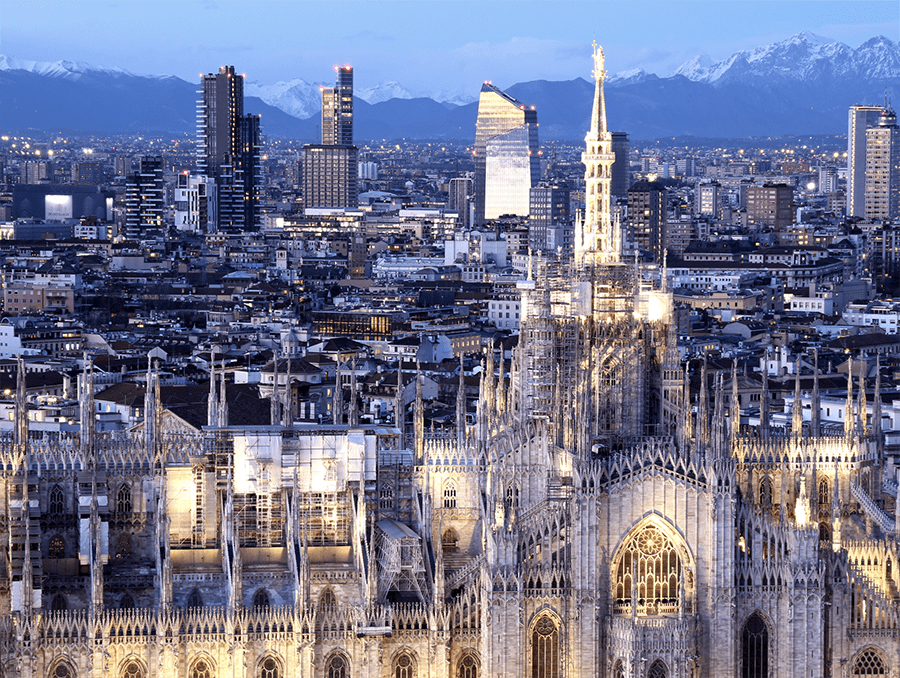

The “Casa” Trend: Luxury Living in Milan’s Exclusive Residences

Milan, the fashion capital of Italy, is experiencing a new trend in luxury accommodations that bridges the gap between high-end hotels and private residences. The "Casa" concept offers discerning travelers…