Il Palagio: A Renaissance Estate’s Modern Revival

Do you want to invest in Tuscany real estate? Contact Columbus International, your trusted agency between Italy and the U.S. Nestled in the undulating hills of Tuscany, south of Florence,…

Do you want to invest in Tuscany real estate? Contact Columbus International, your trusted agency between Italy and the U.S. Nestled in the undulating hills of Tuscany, south of Florence,…

In a landscape where real estate dynamics shift with increasing velocity, Milan continues to reign supreme as Italy's most coveted market. Despite projections from Immobiliare.it Insights indicating residential prices will…

The Miami residential real estate market is experiencing significant shifts as inventory levels rise and prices stabilize. Single-family home inventory jumped 26% year-over-year to 5,041 units in December 2024, while…

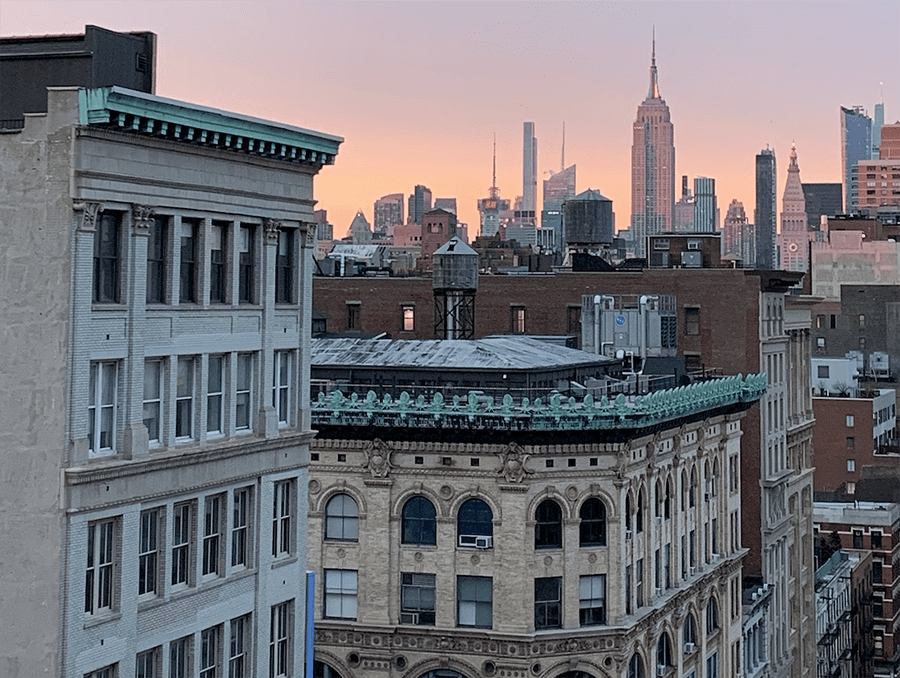

In a striking display of its characteristic maverick nature, New York City's rental market continues to forge its own path, posting significant increases while other major metropolitan areas experience declining…

As the American housing market enters a transformative period under a new administration, industry experts see promising signs of recovery and renewal. With housing affordability playing a pivotal role in…

This article is brought to you by Columbus International Real Estate, your trusted global partner in luxury real estate. With offices in New York, Miami, Milan, and Tuscany, our boutique…

Market Signals Point to a Cooling Trend in Italy's Financial Capital The once-unstoppable Milan real estate market is showing clear signs of deceleration, with data suggesting that both property prices…

For discerning buyers seeking a distinguished West Village brownstone, Columbus International offers unparalleled expertise in Manhattan's luxury market. Reach out today: info@columbusintl.com West Village (New York) - Neighborhood Spotlight https://www.youtube.com/watch?v=RnJjVqNP_G4…

Inside the Exclusive New Marina Residence That's Redefining Mediterranean Luxury Real Estate For those seeking the quintessential Italian coastal lifestyle, a new luxury development in Puntone di Scarlino is offering…

Columbus International: With Decades of Experience in Both Markets, Our Team Offers Unmatched Expertise in Milan Real Estate Investment Opportunities. Contact Our Specialized Brokers Today to Access Premium Properties in…