The Invaluable Role of Real Estate Brokers in New York City

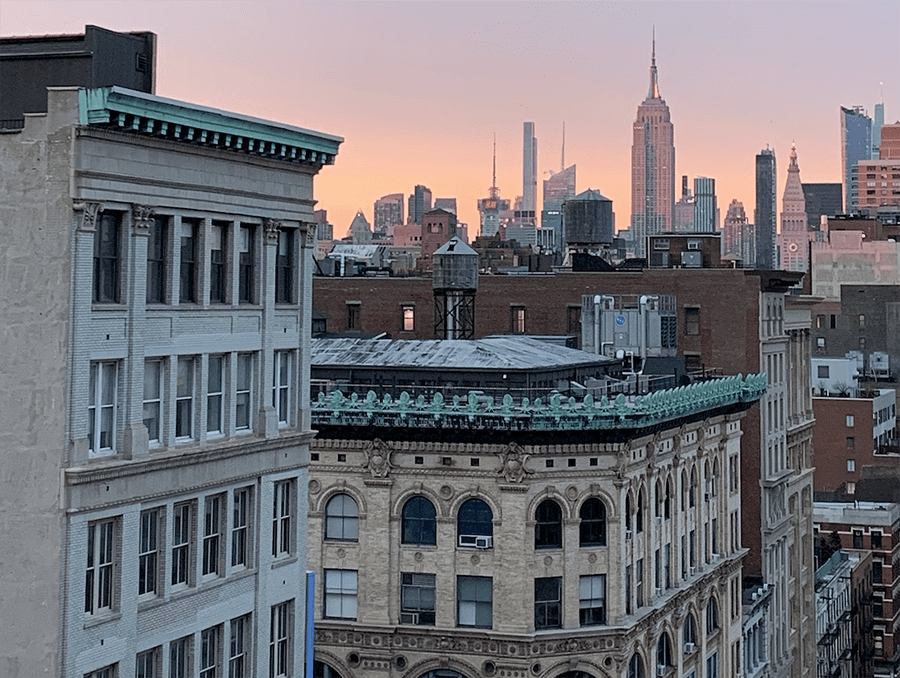

In the concrete jungle of New York City, where the real estate landscape is as towering and complex as its iconic skyline, navigating property transactions without professional guidance can be a daunting endeavor. While New York state law doesn’t mandate broker representation, those who venture into the NYC real estate market solo are often left wondering if they’ve made the right decisions.

Navigating the Labyrinth: Why NYC Real Estate Demands Expertise

New York’s real estate market operates unlike any other in the world. With its distinctive co-op boards, complex approval processes, and hyper-competitive environment, even seasoned investors can find themselves overwhelmed. Each neighborhood comes with its own unwritten rules, price trends, and hidden gems that only market insiders truly understand.

The difference between someone who uses a broker and someone who doesn’t is often measured in thousands of dollars and countless hours saved. At Columbus International’s New York office, brokers frequently see clients who initially tried to navigate the market themselves, only to realize they were missing crucial information that significantly impacted their investment decisions.

Beyond the Search: The Multi-Faceted Role of Today’s Broker

The modern real estate broker is far more than someone who simply shows properties. Today’s brokers are:

- Market Intelligence Specialists: With real-time data and years of experience, brokers can identify value opportunities that online listings simply can’t reveal.

- Negotiation Experts: In a city where every square foot comes at a premium, skilled negotiation can mean the difference between closing a deal or losing your dream property.

- Paperwork Navigators: NYC’s real estate transaction documents can reach hundreds of pages. Brokers ensure that every detail is properly addressed.

- Relationship Curators: The best deals in New York often happen before properties ever hit the public market. Established brokers maintain networks that give their clients first access to off-market opportunities.

The International Advantage

At Columbus International, our unique position bridging the American and Italian markets provides our clients with distinctive advantages. Whether you’re an Italian investor looking at Manhattan opportunities or an American seeking the perfect Milanese apartment, our bicultural expertise ensures you’re never navigating unfamiliar territory alone.

Understanding both markets enables the Columbus International team to provide contextual guidance that’s invaluable to clients. The company prides itself on translating not just the language, but the entire real estate culture, ensuring a seamless experience regardless of which side of the Atlantic the transaction occurs.

The Cost of Going Solo: What You Risk Without Representation

Many first-time buyers or sellers are tempted to handle transactions themselves, believing they’ll save on commission fees. However, this approach often proves more expensive in the long run:

- Unrepresented buyers frequently overpay by 3-7% compared to broker-represented transactions

- Solo sellers typically receive 5-10% less than properties marketed by professional brokers

- Without expert guidance, transaction timelines often extend by weeks or months

- Legal complications arising from improper documentation can cost thousands in remediation

Making the Right Choice

Whether you’re purchasing your first NYC apartment or expanding an international real estate portfolio, professional representation transforms what could be an overwhelming process into a strategic opportunity.

The value of a broker extends far beyond the transaction itself. It’s the confidence that comes from knowing every decision is informed by expertise and experience that truly matters. In a market as competitive and complex as New York City’s, that peace of mind becomes perhaps the most valuable asset of all for clients navigating these challenging waters.

Columbus International Real Estate specializes in residential and commercial properties, with offices in New York, Miami, Milan, and Florence. Our multilingual team of expert brokers provides seamless service for clients navigating both American and Italian real estate markets.