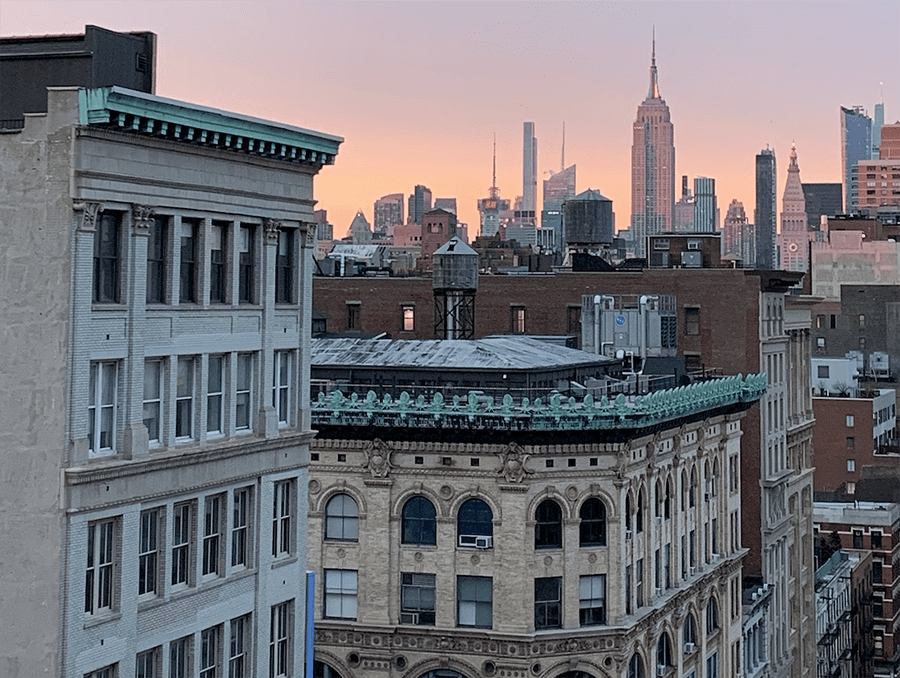

New York Perspective: U.S. Housing Market Gains Momentum as Spring Arrives

National housing transactions surge 23% while New York region watches median prices reach $435,000

The traditional spring momentum in the U.S. residential real estate market has arrived with impressive force, according to the latest RE/MAX USA Market Housing Report. March data reveals a substantial 23% month-over-month increase in housing transactions across the 50 metropolitan areas analyzed, marking the largest monthly gain since March 2023’s 37.4% surge.

Market Fundamentals Strengthen, New York Investors Take Note

This sales acceleration comes amid growing inventory, with available homes for sale increasing 8% from February and a remarkable 35.5% year-over-year. New listings have played a critical role in this inventory expansion, jumping 29.8% from February and 7.9% compared to March 2024.

Meanwhile, the median home price reached $435,000 in March, representing a $8,000 increase (1.8%) from February and a $15,000 gain (3.5%) from the previous year. For New York-based real estate investors looking beyond the high-priced metropolitan area for yield opportunities, these national figures represent potential in markets with stronger growth trajectories and lower entry points.

“The arrival of spring, traditionally the most active season for real estate, coupled with increased sales and inventory, could drive further market acceleration,” notes Erik Carlson, CEO of RE/MAX Holdings. “With solid housing availability and stable interest rates—with potential reductions on the horizon—many buyers view current market conditions as the most favorable in recent years.”

New York Regional Context

While Washington D.C. led all metropolitan areas with a 25.3% month-over-month inventory increase, the New York metropolitan region is navigating its own market dynamics within the national spring uptick. The Tri-State area continues to be influenced by the broader national trends of increasing inventory and strong pricing.

According to Bryan Cantio of RE/MAX Allegiance in Washington D.C., this growth became particularly evident mid-month: “We’ve observed gradual inventory increases since January, but the market accelerated more decisively by mid-March. This represents a positive development for buyers who have faced housing shortages for nearly two decades, while sellers will likely need to adapt to greater market uncertainty.”

For New York-based investors and homeowners, these national patterns provide context for local market conditions, where proximity to financial markets and the region’s unique housing density create distinctive market characteristics.

Key Performance Metrics

The RE/MAX report highlighted several other significant market indicators:

- Buyers paid an average of 99% of asking price, consistent with both February 2025 and March 2024 figures

- Homes sold in an average of 44 days, down from 51 days in February but still five days longer than March 2024

- Housing supply measured 2.3 months, below February’s 2.7 months but above the 1.7 months recorded last year

Top Markets for New Listings

The metropolitan areas recording the strongest year-over-year growth in new listings were:

- Las Vegas: +28%

- Nashville: +26.5%

- Manchester: +26.3%

Conversely, Birmingham (-13.4%), Minneapolis (-12.7%), and Des Moines (-12%) experienced the most significant declines.

Transaction Leaders and Laggards

While overall transactions decreased 1.4% year-over-year, certain markets outperformed:

- San Francisco: +13.3%

- Fayetteville: +9.9%

- Dover: +8.4%

Markets showing the steepest annual transaction declines included Bozeman (-11.9%), New Orleans (-11.7%), and Atlanta (-9.5%).

Price Trends and Market Dynamics

Burlington led all markets with a striking 22.4% year-over-year price increase, followed by Trenton (+9.7%) and Fayetteville (+8.8%). Price decreases were most pronounced in Honolulu (-4.5%), Omaha (-3.2%), and New Orleans (-1.8%).

The sale-to-list price ratio reveals additional market dynamics. San Francisco (104.8%), Hartford (103.3%), and Trenton (101.3%) commanded the highest ratios, indicating properties selling above asking price. Miami (94.1%), Bozeman (96.2%), and Tampa/New Orleans (both 96.6%) recorded the lowest ratios.

Market Velocity

Properties sold fastest in Washington D.C. (16 days), Baltimore (17 days), Manchester (17 days), and Philadelphia (18 days). The slowest-moving markets were Bozeman (84 days), Fayetteville (80 days), and New Orleans/Miami (both 75 days).

With inventory levels continuing to rise and spring market momentum building, the residential real estate market appears positioned for an active season ahead, balancing increased choices for buyers with potentially shifting dynamics for sellers. For New York-based readers watching both local and national housing trends, this data offers valuable insights for portfolio diversification beyond the city’s borders, while highlighting the broader economic currents affecting real estate from Manhattan to Miami.