Rise of Hudson Yards: From Urban Oasis to Office Epicenter (The New York Times)

In March 2019, on the west side of Manhattan, 13,000 people flocked to the Hudson River to witness the unveiling of Hudson Yards, the largest private real estate venture in U.S. history. However, just a year later, the vibrant energy of that opening seemed a distant memory as the new construction lay silent amidst the pandemic.

The once lively corridor of luxury skyscrapers and high-end commercial spaces along the Hudson River had been subdued by closures and urban vacancies. With an extraordinary investment of approximately $30 billion, the ambitious neighborhood appeared to teeter on the brink of failure. Yet, five years later, Hudson Yards not only persevered its initial spirit but emerged as a beacon of resilience, becoming, according to The New York Times, the most sought-after workplace in New York City.

Amidst a shift in remote and hybrid work models, the neighborhood’s glass and steel towers have become magnets for some of the world’s most esteemed companies – BlackRock, Pfizer, Ernst & Young – willing to pay astronomical sums for prime real estate and locations. A remarkable resurgence that silenced even the critics who once looked suspiciously upon the Hudson Yards project, deeming it a soulless enclave catering solely to the wealthy elite. While the office sector thrives, other components of the project, particularly luxury residential buildings and a large shopping center, have struggled to take off. This divergence underscores the growing gap between the fortunes of elite office towers like those around Grand Central Terminal and the broader challenges facing Manhattan’s real estate landscape.

Across Manhattan, the office vacancy rate has reached approximately 18%, nearing record levels with no immediate signs of improvement. However, in Hudson Yards, vacancy rates remain below 10%, with several buildings boasting full occupancy. Rental prices have soared, with some spaces commanding nearly triple the city average. The resurgence of pedestrian traffic, especially at the neighborhood’s shopping center, signals a promising recovery, with companies reporting attendance rates similar to pre-pandemic levels. In particular, employee presence exceeds 80% on weekdays, in stark contrast to the subdued activity observed in other office buildings across the city. Initially criticized as an unnecessary gift to promoters and developers, the tax incentives provided by the city have proven instrumental in the success of Hudson Yards.

Developers argue that without these incentives, the project would have been at risk. The recent relocation of Cravath, Swaine & Moore, a prestigious law firm, to Two Manhattan West, further solidifies Hudson Yards’ status as a premier business hub. Major corporations cite the allure of modern, expansive office spaces as a primary attraction, with companies like BlackRock consolidating their operations within the neighborhood, setting a new standard in luxury office spaces.

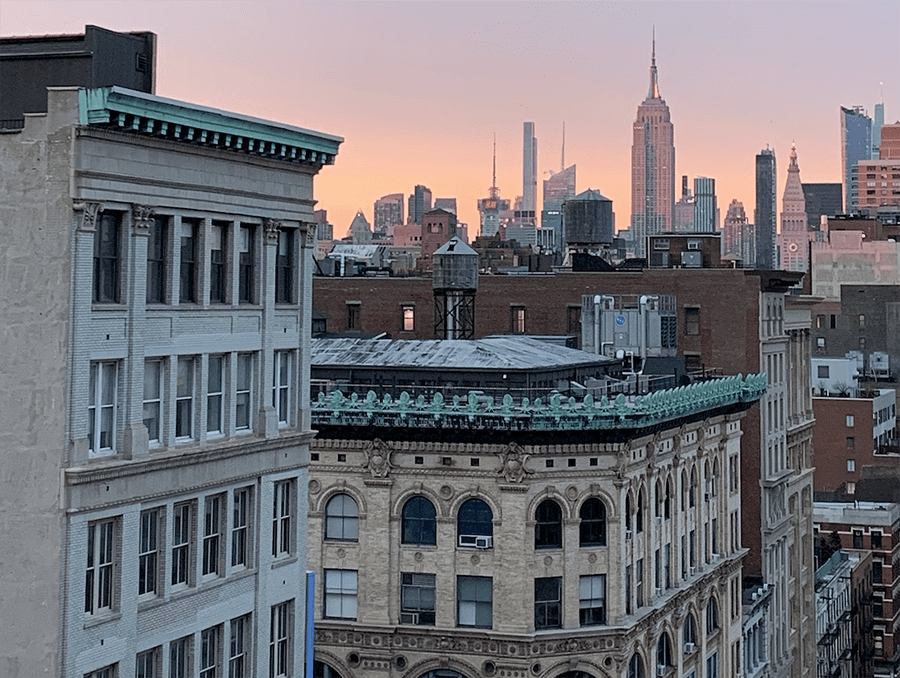

Photo via 15 Hudson Yards