New York City’s Office Market Defies Expectations, Surpasses Pre-Pandemic Value

In a surprising twist that challenges conventional wisdom, New York City’s office market has demonstrated remarkable resilience, surpassing its pre-pandemic value despite record-high vacancy rates. This unexpected development, revealed in a recent study by New York State Comptroller Thomas DiNapoli’s office, paints a complex picture of the city’s commercial real estate landscape.

The Numbers Tell a Tale

The total assessed value of New York City’s office market climbed to an impressive $205 billion in fiscal year 2025, marking a 4.4% increase from the $196.2 billion recorded in fiscal year 2020. Even more striking is the 7% rise in total taxable billable value, reaching nearly $72 billion over the same period.

These figures, primarily derived from the city’s Department of Finance records, underscore the office market’s critical role in New York’s economic ecosystem. Commercial real estate, with offices at the forefront, accounts for a substantial 22% of all property market value in the city as of fiscal year 2025.

A Shift in the Skyline

Interestingly, this growth isn’t emanating from the traditional Midtown Manhattan strongholds. Areas like Midtown East, Grand Central, and Times Square have actually seen their values decline since fiscal year 2020. Instead, the expansion is being driven by newer, more dynamic districts.

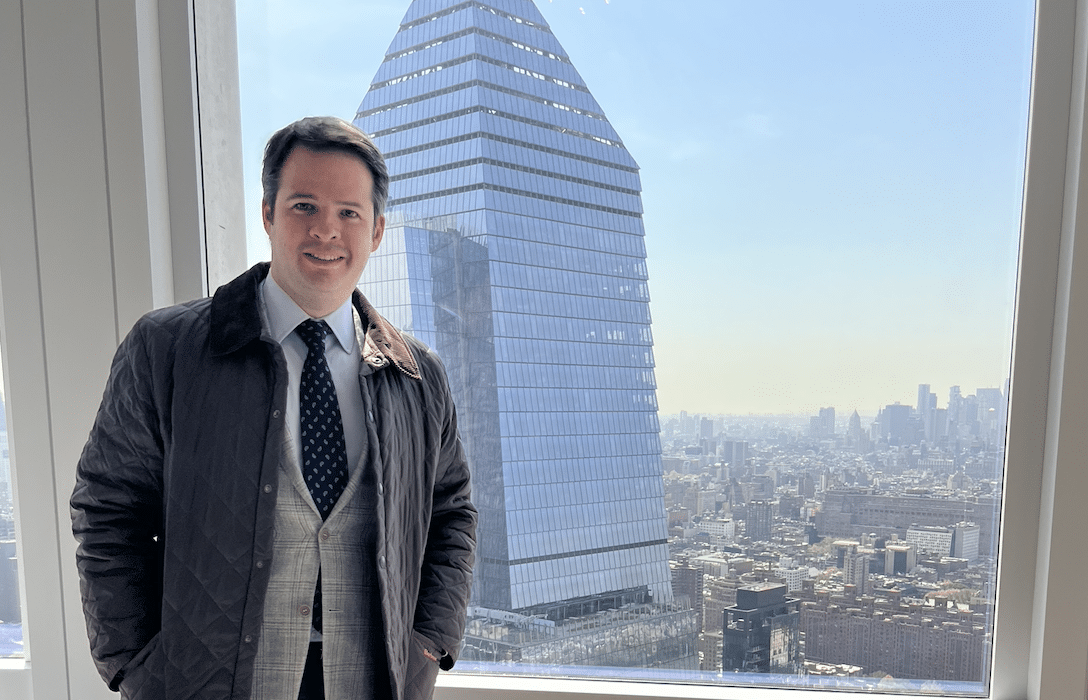

The Hudson Yards Effect

Leading the charge is the Hudson Yards development on Manhattan’s far west side. This burgeoning district alone contributed a staggering $6 billion increase in value, representing about 70% of the total growth. Rahul Jain, New York state’s deputy comptroller, describes the growth in Hudson Yards as “humongous,” citing new buildings from developers like Related Cos., Brookfield, and Tishman Speyer as key drivers.

“We are seeing leasing in those buildings. Tenants they are bringing in are large conglomerates like Pfizer and BlackRock,” Jain noted, highlighting a shift from traditional office clusters to this new hub of commercial activity.

Emerging Hotspots

Beyond Hudson Yards, other areas showing significant growth include:

- Union Square: 19% growth

- SoHo: 28% jump

- Downtown Brooklyn and Dumbo: Nearly 20% growth

- Long Island City, Queens: An impressive 65% jump

The Flight to Quality

The study reveals a clear trend towards newer, amenity-rich buildings. Offices constructed after 2010 are leading the market value growth, reflecting employers’ preferences for modern spaces that can attract and retain talent in a competitive job market.

Challenges Amidst Growth

Despite the overall positive trends, the New York office market isn’t without its challenges. The office vacancy rate in Manhattan hit a record high of nearly 24% in the second quarter, up from about 11% in the fourth quarter of 2019. Many companies continue to reassess their space needs in light of remote and hybrid work arrangements.

Looking Ahead

While the office market’s value has surpassed pre-pandemic levels, the growth rate has slowed considerably. Pre-pandemic annual average value growth of 6% to 7% has decelerated to under 1.5% annually since the onset of COVID-19.

The Bottom Line

New York City’s office market is demonstrating remarkable adaptability and resilience in the face of unprecedented challenges. While traditional business districts may face a longer road to recovery, emerging areas and high-quality spaces are driving growth and reshaping the city’s commercial landscape. As the market continues to evolve, investors and businesses alike will need to stay attuned to these shifting dynamics to capitalize on the opportunities they present.

Source: CoStar News