NYC’s New Price Champion: The $110 Million Quadplex in the World’s Skinniest Tower

A new listing in Manhattan’s iconic Steinway Tower becomes the city’s priciest home on the market

In a city known for architectural superlatives and eye-watering real estate prices, a new champion has emerged. A spectacular four-level penthouse in Manhattan’s needle-like Steinway Tower has just hit the market for $110 million, making it the most expensive home currently for sale in New York City.

The Ultimate Billionaires’ Row Address

Located at 111 W. 57th St. on the exclusive stretch known as Billionaires’ Row, this extraordinary “quadplex” spans the 80th through 83rd floors of what is officially the world’s skinniest skyscraper. The property, listed Thursday according to StreetEasy, offers 11,480 square feet of interior space along with 618 square feet of outdoor terraces.

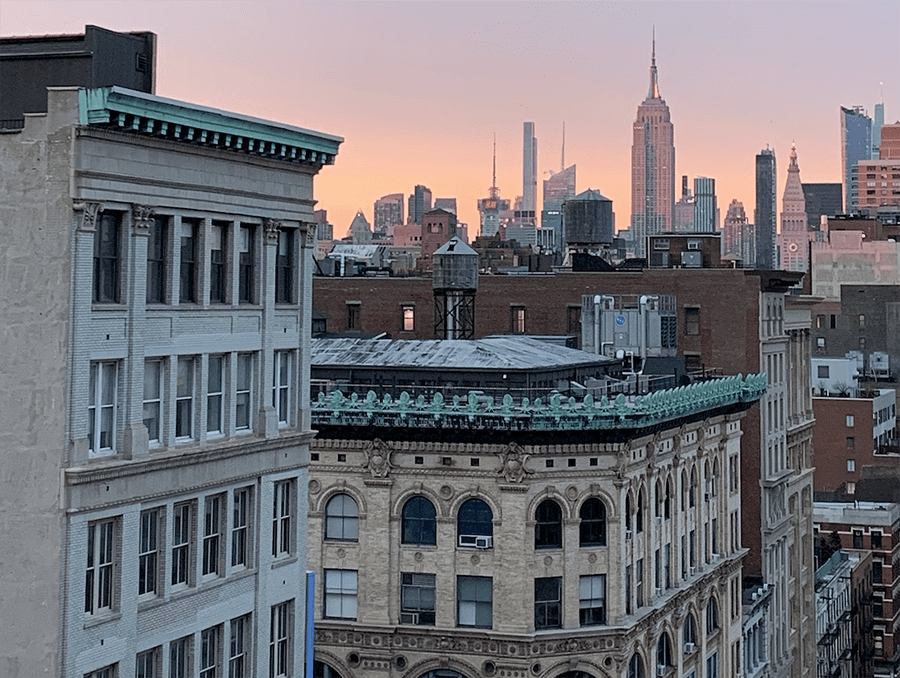

What makes Steinway Tower particularly remarkable is its slenderness ratio of 1:24, meaning it’s 24 times taller than it is wide—a feat of engineering that earned it the title of world’s skinniest skyscraper. For comparison, the Empire State Building has a slenderness ratio of just 1:3. The tower’s distinctive pinnacle, resembling a feather, has become an instantly recognizable addition to the Manhattan skyline since the building opened in 2022.

A Blank Canvas for the Ultra-Wealthy

The vacant penthouse currently features five bedrooms and six full bathrooms, with soaring 14-foot ceilings and floor-to-ceiling windows that provide panoramic views of the city. Studio Sofield designed the suggested floor plan, but notably, the $110 million asking price includes a complete buildout and redesign according to the buyer’s specifications.

Each floor serves a distinct purpose in the current layout:

- The first level (80th floor) contains a grand entry hall and south-facing kitchen with terrace access

- The second level houses four ensuite bedrooms, a lounge area, and wet bar

- The third level is dedicated to a massive 2,800-square-foot primary suite with dual bathrooms clad in gray and white onyx

- The fourth level “crown suite” is designed for entertaining, featuring a bar, private screening room, service kitchen, and outdoor terrace

A Rarified Market Segment

True quadplexes are exceedingly rare in Manhattan. The most notable comparable property is hedge fund billionaire Ken Griffin’s approximately $238 million quadplex at 220 Central Park South, purchased in 2019—a deal that still holds the record for the most expensive home ever sold in the United States.

Lead listing broker Nikki Field of Sotheby’s International Realty explained to Bloomberg that the Steinway Tower penthouse was originally configured as two separate duplexes before the decision was made to combine them into this unprecedented offering.

Timing the Ultra-Luxury Market

The listing emerges as Manhattan’s ultra-luxury market experiences a significant uptick amid limited inventory. Previously, neighboring Central Park Tower held the title of most expensive listing with units priced at $250 million (later reduced to $195 million) and $150 million, but neither remains on the market today.

Steinway Tower itself has seen a remarkable sales resurgence. Since Nikki Field’s team at Sotheby’s took over marketing in summer 2024, the building has been “rebranded, repriced and restaffed,” resulting in $187 million in contracts currently in progress, including eight deals signed this year alone. Among those is Penthouse 72, which commanded $56 million.

“I’m looking for Jeff Bezos 2.0 at 111,” Field told The Post, referencing her previous sale to the Amazon founder at 212 Fifth Avenue.

The launch of Penthouse 80 represents a vote of confidence in the tower’s sales momentum after a challenging beginning. Despite initial sluggish sales following its 2022 opening, Field indicated to Bloomberg that the penthouse was strategically held back until market conditions improved.

“This very healthy luxury spring market,” Field said. “We had no excuses to delay the launch.”

The Developers Behind the Tower

Steinway Tower was developed through a collaboration between JDS Development Group, Property Markets Group, and Apollo Commercial Real Estate Finance. With 59 total units, each occupying at least one full floor, the building stands as the second-tallest residential tower in the United States.

As Manhattan’s luxury real estate market continues its strong performance in early 2025, all eyes will be on whether this architectural marvel’s crown jewel can secure its $110 million asking price—and perhaps on which billionaire might soon call it home.