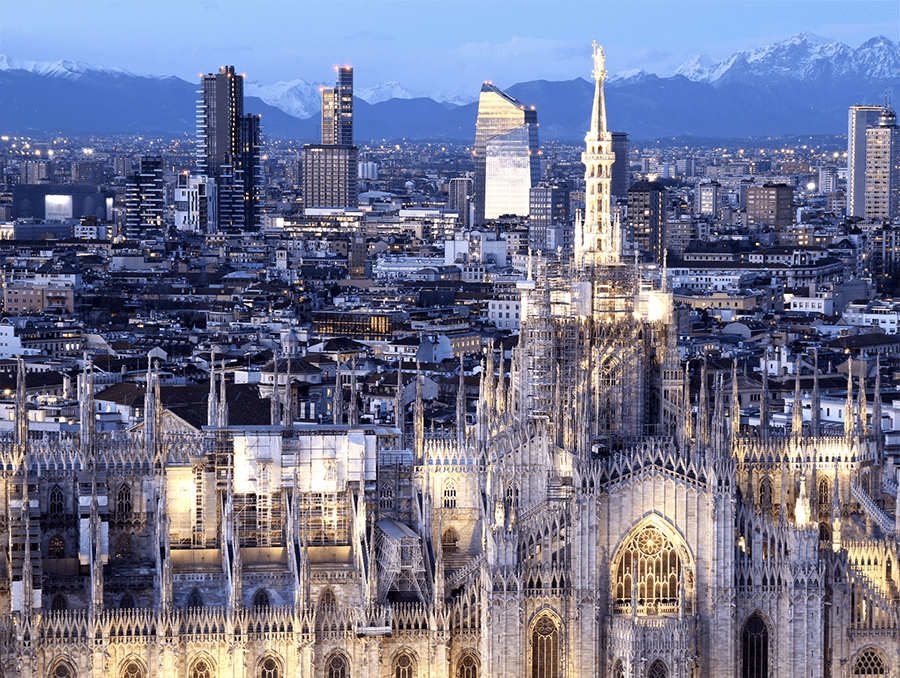

Rental opportunities on the rise. From Milan to Florence, it’s the perfect time to invest in Italy (Immobiliare.it)

The rental costs in the main Italian cities have become so high as to exclude both individuals and families with a single income. It’s interesting to note that it’s not Milan, but Florence, that emerges as the least accessible city for those seeking a two-room apartment for rent. And this makes it a great asset if you’re looking for a secure real estate investment.

According to insights from Immobiliare.it, the proptech company affiliated with Immobiliare.it, the average monthly amount a person would need to allocate for rent – ideally not exceeding 30% of their net income – has been compared with the actual average rent demanded for a two-room apartment in major urban centers. In Florence, for instance, the average monthly rent for a two-room apartment stands at 1,066 euros, yet the average budget available for a single individual barely surpasses 480 euros. Shockingly, only 0.5% of the two-room apartments listed in the market are affordable for solo renters. Following closely is Naples, where the average monthly rent climbs to 850 euros, but given the municipality’s average income, a single person can only afford around 415 euros for rent, less than half of the required amount. Consequently, the accessibility rate falls below 1%.

Milan boasts the highest rental rates among the cities under scrutiny, with rents exceeding 1,320 euros per month for a two-room apartment, while the budget available to a single individual, at 650 euros, falls significantly short. A similar situation unfolds in Venice, where despite an average monthly rent of approximately 880 euros, a single person can only afford 430 euros, less than half of the required sum. Moreover, while in Milan only 0.8% of the two-room apartments on offer are within reach for solo renters, the situation in Venice is even direr, with no affordable options available. Single individuals face challenging rental conditions in Bari and Bologna as well. In Bari, where the rent for a two-room apartment has surged by nearly 200 euros per month over the past year, reaching 800 euros, the average salary fails to meet the required amount, hovering around 430 euros. Meanwhile, in Bologna, the average rent stands at about 925 euros per month, exceeding what a person could realistically pay by 510 euros. In Rome, there’s a glaring disparity between the rent demanded by landlords and the budget available to renters, with a gap of over 70%. Landlords request an average monthly rent of 890 euros, while the budget of a single individual barely reaches 520 euros. Verona fares slightly better, with an average monthly rent of 770 euros, aligning closer to the budget of around 480 euros that a resident can allocate for rent. In the two major Sicilian cities, Palermo and Catania, the gap between the rent demanded by landlords and the budget of single renters hovers around 45%. In both cities, the monthly rent slightly exceeds 580 euros, while renters can only afford around 400 euros. In municipalities like Turin and Genoa, where the available budget for renting a two-room apartment closely matches the rent demanded, there’s a more balanced situation. In Turin, the average monthly rent slightly exceeds 600 euros, whereas a single individual can afford around 500 euros. Similarly, in Genoa, the gap between the average monthly rent of 550 euros and the personal resources of 450 euros is narrower. Notably, Genoa remains the city with the highest accessibility to two-room apartments for single renters, with 38% of the available stock.

Antonio Intini, Chief Business Development Officer of Immobiliare.it, commented: “The analysis reveals that the rental market in our major cities offers few sustainable options for those with a single income. In most cases, single individuals must allocate at least 50% more than the considered sustainable budget for rent, if not double. Considering the potential for further rent hikes, it’s imperative to reflect on the future of our main urban centers, which are becoming increasingly inaccessible to new generations, forcing them to seek housing solutions in the outskirts and potentially weakening the socio-economic fabric of the cities.”

Source: Monitor Immobiliare