World Capital Group: Milan Office Market Analysis – Q3 2024

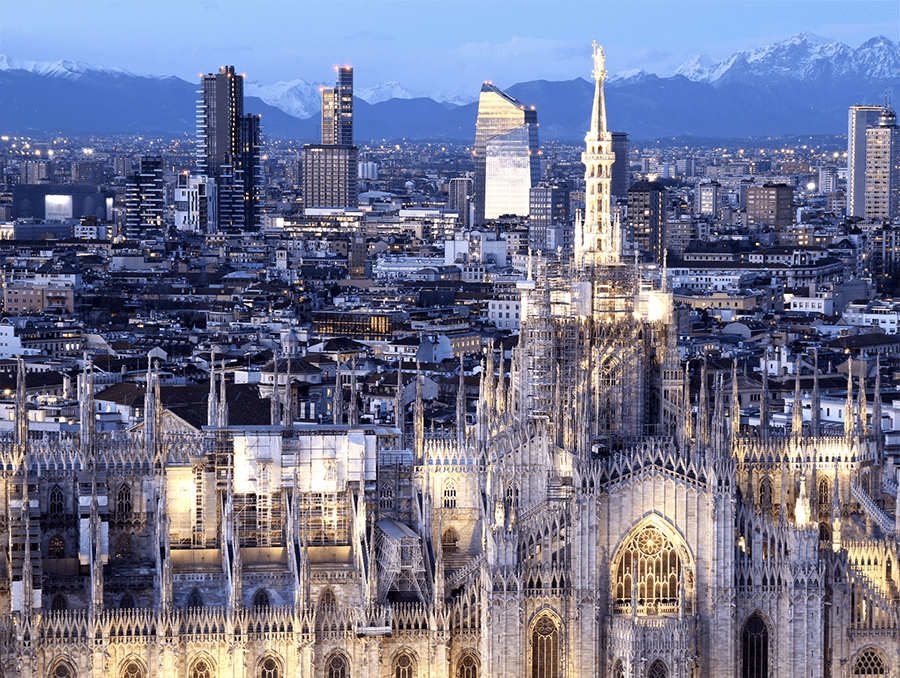

World Capital Group has released an in-depth analysis of Milan’s commercial real estate market for the third quarter of 2024, reaffirming the preeminence of the City Center and Garibaldi districts in Italy’s prime office sector.

Market Overview

The Milan office market demonstrates exceptional resilience, characterized by sustained rental rates across both metropolitan and suburban locations. The REAI_O (Real Estate Attractiveness Index Office) substantiates this robust performance, underscoring Milan’s increasing appeal to institutional investors.

Rental Rates and Investment Yields

The historic core, particularly the Duomo district, commands premium rents ranging from €570 to €730 per square meter annually. Investment yields in central locations average 4.3%, with the Business District achieving a compressed yield of 4.2%. Semi-peripheral areas exhibit more attractive yields, peaking at 7% in emerging submarkets such as Città Studi, Pasteur, Rovereto, and NoLo.

REAI_O: Advanced Market Analytics

The sophisticated REAI_O index, engineered to quantify district-specific market attractiveness, incorporates key performance indicators:

- Rental values

- Capital values

- Investment yields

- Market fundamentals

- Sector-specific metrics

Submarket Performance

The REAI_O index highlights exceptional performance across key submarkets: Prime Central Business District:

- Duomo: 127.31

- Centrale/Repubblica: 100.48

- Garibaldi/Moscova/Porta Nuova: 96.23

Greater Metropolitan Area:

- Assago: 7.17

- Segrate: 5.39

- San Donato Milanese: 5.29

The metropolitan area’s robust economic fundamentals continue to drive growth in peripheral submarkets, reinforcing Milan’s status as Italy’s premier commercial real estate destination.

Market Outlook

Marco Clerici, Head of Research & Advisory at World Capital Group, observes: “Milan consistently reinforces its position as the epicenter of Italy’s commercial real estate sector. The city’s proven ability to attract domestic and international occupiers, coupled with its dynamic urban transformation, establishes it as a benchmark for European commercial centers. Our Q3 2024 findings demonstrate how Milan’s strategic development initiatives and enhanced market fundamentals sustain its competitive advantage both nationally and within the broader European context.”

Source: Monitor Immobiliare