Milan’s real estate market is demonstrating remarkable resilience and growth in 2025, with property prices continuing their upward trend to reach an average of €5,500 per square meter. This price point represents a significant milestone in the city’s ongoing transformation into one of Europe’s most sought-after property markets.

Sustained Growth in a Dynamic City

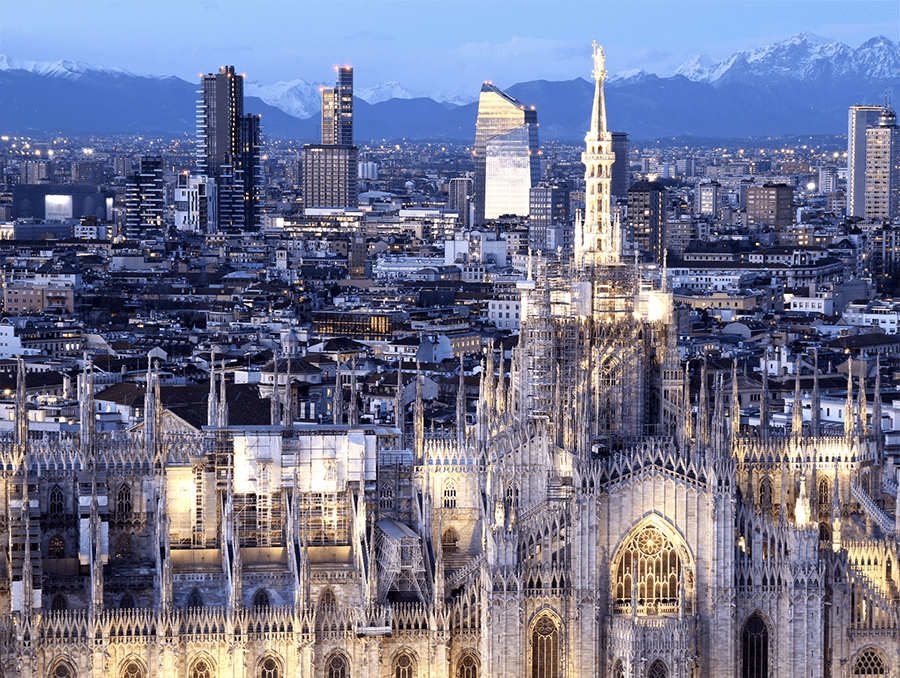

The continued price appreciation in Milan reflects the city’s enduring appeal as Italy’s financial and fashion capital. Despite global economic fluctuations, Milan has managed to maintain investor confidence through its strong economic fundamentals, cultural significance, and strategic importance in the European business landscape.

Real estate analysts attribute this sustained growth to several key factors, including limited housing supply in desirable central districts, ongoing urban regeneration projects, and Milan’s enhanced international profile following successful events like the 2026 Winter Olympics preparations.

Investment Trends Across Italy

Italians continue to view real estate as a solid investment vehicle. According to a study by Gruppo Tecnocasa’s research office, 19% of property purchases throughout Italy in 2024 were made specifically for investment purposes. While this figure represents a slight decrease from the previous year, it still indicates strong confidence in the “mattone” (brick) as a reliable asset class.

Within this national context, Milan remains a top destination for investment purchases, with 28.2% of all transactions in the city during 2024 classified as investment properties—homes purchased specifically to generate rental income. However, in the national ranking of investment-focused markets, Milan does not hold the top position. Naples leads the country with 39% of transactions being investment purchases, followed by Palermo (36%), Verona (32.2%), and Bari (30.5%).

Preferred Property Types and Investor Profiles

The two-bedroom apartment (bilocale) remains the most sought-after property type for investment purposes across Italy. In 2024, these units accounted for 32.5% of all investment purchases nationwide, followed by three-room apartments (trilocali) at 27.4%. Notably, there has been an increase in purchases of larger properties as well.

The typical real estate investor in Italy is someone who already owns their primary residence. The most active age group in this market segment is 45-54 years (27.7% of investors), followed by 35-44 years (22.6%) and 55-64 years (21.8%). Couples and families dominate the investment market, accounting for 72% of purchases, while singles represent less than 30%. Perhaps most significantly, 86% of investment property purchases are made in cash, without requiring mortgage financing.

District Variations and Investment Hotspots

While the €5,500 per square meter represents an average across the city, prices vary significantly between neighborhoods. Premium locations such as Brera, Porta Nuova, and the Quadrilatero della Moda command substantially higher prices, often exceeding €10,000 per square meter for luxury properties.

Meanwhile, emerging districts like NoLo (North of Loreto), Isola, and areas surrounding the Scalo Farini redevelopment project are experiencing the most dynamic price growth as they undergo gentrification and attract younger professionals and families.

Market Dynamics and Buyer Profiles

The buyer landscape in Milan has evolved notably in recent years. International investors continue to view the city as a safe haven for capital, while domestic buyers increasingly prioritize energy-efficient homes with outdoor spaces—a trend accelerated during the pandemic years that shows no signs of reversing.

The luxury segment remains particularly robust, with high-net-worth individuals from across Europe, the Middle East, and Asia seeking trophy assets in Italy’s most cosmopolitan city. Simultaneously, the growing presence of international companies establishing or expanding their Italian headquarters in Milan has fueled demand in the premium rental market.

Future Outlook and Challenges

While the market continues to perform strongly, challenges loom on the horizon. Affordability concerns are mounting as local incomes struggle to keep pace with property price appreciation. This discrepancy has prompted discussions among city officials about potential measures to increase housing accessibility for Milan residents.

Additionally, interest rate policies at the European level could influence mortgage affordability and potentially moderate price growth in the coming years. However, most market observers expect Milan’s property prices to continue their upward trajectory, albeit potentially at a more moderate pace.

The city’s commitment to sustainability and smart urban development, exemplified by projects like MIND (Milano Innovation District) and the ongoing regeneration of former industrial areas, is expected to create new investment opportunities while addressing some of the supply constraints that have contributed to rising prices.

For investors and homebuyers alike, Milan’s real estate market in 2025 presents both opportunities and challenges, requiring careful consideration of location, property type, and long-term objectives in a city that continues to reinvent itself while honoring its historic character.

Source: Repubblica