From Medieval Castles to Fashion Palazzos: Luxury Gastronomy Reshapes Italian Real Estate

Columbus International, with its signature expertise in luxury real estate across New York, Miami, Milan and Tuscany, continues to witness how exceptional dining experiences are transforming historic properties into world-class destinations. Two recent developments highlight this trend that savvy real estate investors should note.

Castello di Fighine: A Medieval Marvel Reborn Through Gastronomy

In the heart of Tuscany’s Val d’Orcia, an extraordinary transformation has occurred. What began in 1266 as a fortress granted by Frederick II of Swabia to Tancredi Campiglia has evolved into one of Italy’s most exclusive gastronomic destinations.

The once-abandoned medieval hamlet of Fighine has been meticulously restored to offer 34 luxury accommodations spread across five elegantly designed villas, two apartments, and various historic structures including a consecrated 18th-century church. The conservative yet luxurious interior design by international designers David Mlinaric and Hugh Henry creates an atmosphere of authentic country elegance with functional luxury.

At the heart of this renaissance is the Michelin-starred restaurant Castello di Fighine. Under the guidance of three-starred chef Heinz Beck (of Rome’s La Pergola) and led by talented head chef Francesco Nunziata, the restaurant offers sophisticated tasting menus (€130 for 5 courses, €150 for 7 courses) featuring locally sourced ingredients, many from the property’s organic garden.

Dining here means experiencing culinary mastery within two-meter thick stone walls, where dishes like the “Cappelletti alla Genovese with balsamic vinegar and Parmigiano fondue” blend regional Italian influences with technical precision. The restaurant’s intimate setting, with well-spaced tables and views of the surrounding greenery, creates an atmosphere of protected exclusivity.

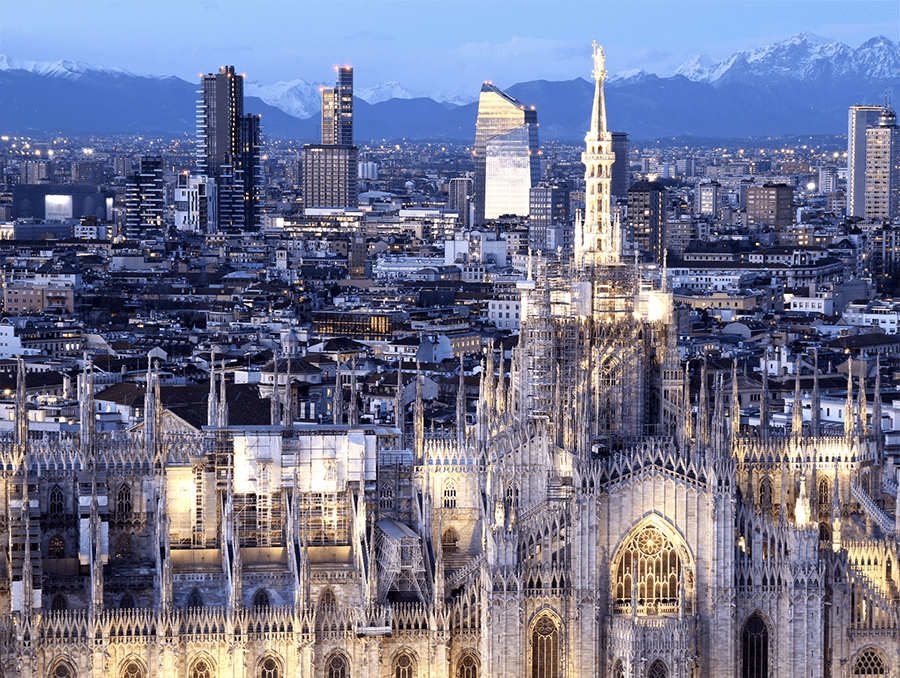

Louis Vuitton Brings Luxury Dining to Milan’s Fashion District

Meanwhile, in Milan’s prestigious Quadrilatero della Moda, luxury fashion house Louis Vuitton is extending its brand into the culinary world with the opening of “DaV by Da Vittorio Louis Vuitton” this April. Located in Palazzo Taverna on Via Montenapoleone, the restaurant will be accessible from both the maison’s showroom and Via Bagutta.

This collaboration with the three-Michelin-starred Da Vittorio restaurant group marks Louis Vuitton’s first gastronomic venture in Italy, following successful dining establishments in France, Japan, China, and the United States. The Cerea family, owners of Da Vittorio, promise a blend of Italian culinary tradition with international creativity in a contemporary setting.

The restaurant will feature Louis Vuitton’s Art de la Table collections and design elements that blend the brand’s aesthetic with Italian cultural influences. While described as “casual dining,” this venture represents the growing intersection of high fashion and fine dining in premium real estate locations.

Columbus International: Pioneering Luxury at the Intersection of Real Estate and Lifestyle

For Columbus International’s discerning clients, these developments represent more than culinary news—they signal lucrative investment opportunities. Properties adjacent to such prestigious culinary destinations often see significant appreciation in value.

In Tuscany, Columbus International has long specialized in identifying and representing historic properties with restoration potential similar to Castello di Fighine. Our expertise in navigating Italian restoration regulations and sourcing authentic materials has helped numerous clients transform ancient structures into luxury accommodations.

In Milan, our team’s intimate knowledge of the fashion district allows us to identify properties with potential for luxury brand partnerships or high-end commercial conversions. The Louis Vuitton restaurant exemplifies how historic palazzos can be reimagined for contemporary luxury experiences while maintaining their architectural integrity.

Whether you’re seeking a Tuscan estate with culinary potential or a Milan property in proximity to luxury retail and dining experiences, Columbus International’s boutique approach ensures personalized guidance through every aspect of acquisition, restoration, and potential commercial partnerships.

As these two distinctive developments demonstrate, the intersection of historic properties and exceptional dining creates a uniquely compelling value proposition in luxury real estate—an area where Columbus International continues to lead with unparalleled expertise and vision.