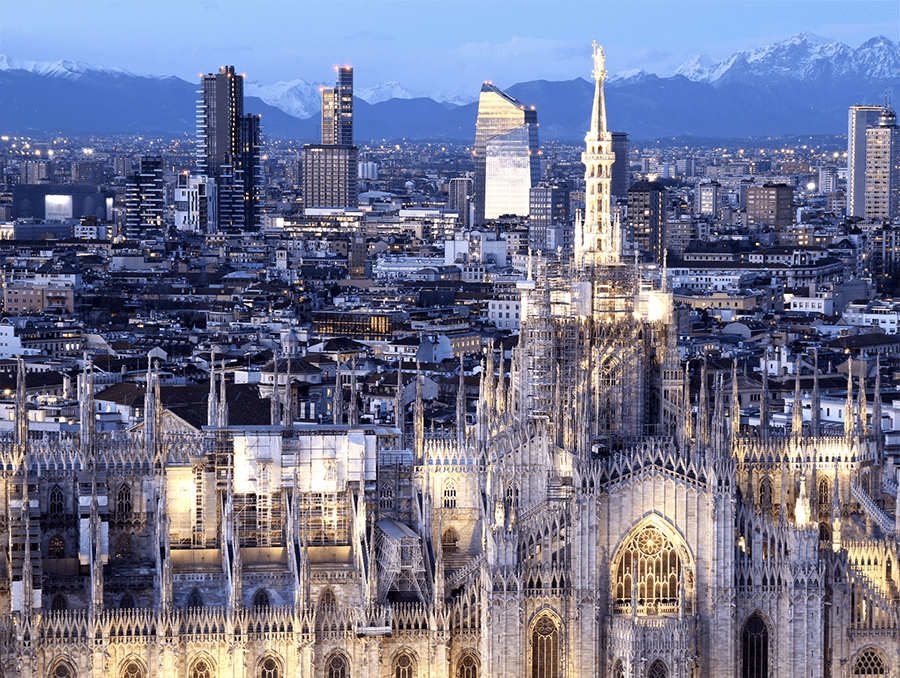

CityLife Milan: Redefining Urban Living in the Heart of Italy’s Fashion Capital

In the bustling metropolis of Milan, a revolutionary urban development is reshaping the city’s skyline and redefining the concept of modern living. CityLife Milan, an ambitious project spanning an impressive 366,000 square meters, is setting new standards in urban planning and architectural innovation.

The Future of Urban Development

At its core, CityLife Milan represents a bold vision for the future of urban spaces. This meticulously planned development seamlessly blends public and private sectors, creating a harmonious ecosystem that caters to both residents and businesses. The project’s innovative approach challenges traditional city planning norms, offering a glimpse into the future of urban living.

A Skyline Transformed

The development’s crown jewels are three towering commercial structures that dominate the Milan skyline. These architectural marvels serve as more than just office spaces; they are the heartbeat of CityLife, around which the entire project revolves. Their striking designs not only symbolize modernity but also act as a beacon for Milan’s economic ambitions.

Redefining Residential Living

Surrounding these commercial giants are clusters of residential buildings that redefine luxury living. These homes are not mere afterthoughts but integral components of the CityLife vision. Each residential complex is a testament to contemporary design, offering residents a unique living experience that seamlessly integrates with the development’s commercial and public spaces.

Green Spaces: The Lungs of CityLife

In a refreshing departure from typical urban developments, CityLife Milan places significant emphasis on public green spaces. These areas are not just aesthetic additions but are crucial to the project’s holistic approach to urban living. Lush parks and carefully landscaped gardens serve as communal retreats, offering residents and visitors a much-needed escape from city life.

The Economic Implications

CityLife Milan is more than just an architectural feat; it’s a strategic investment in Milan’s future. The project is poised to attract international businesses, boosting the city’s already formidable economic status. Moreover, it’s likely to spark a real estate boom in surrounding areas, potentially reshaping Milan’s property market.

A Model for Future Cities

As urban populations continue to grow globally, developments like CityLife Milan offer valuable insights into sustainable urban planning. Its integrated approach to combining commercial, residential, and public spaces could serve as a blueprint for future city developments worldwide.

The Bottom Line

CityLife Milan represents a bold step into the future of urban development. By reimagining the relationship between commercial spaces, residential areas, and public domains, it sets a new standard for city planning. As the project continues to evolve, it will undoubtedly cement Milan’s position as a leader in innovative urban design and sustainable living.

For investors and urban planners alike, CityLife Milan is a project to watch closely. It may well be the harbinger of a new era in urban development, one that prioritizes holistic living experiences over mere functionality. As cities worldwide grapple with the challenges of urbanization, CityLife Milan stands as a shining example of what’s possible when vision meets execution in the realm of urban planning.

Photo via City-Life