NYC Retail Surge: IBM Building On Sale as Madison Avenue Booms

Historic IBM Building Hits Market at $1.1 Billion While Madison Avenue Retail Flourishes

In a pivotal moment for Manhattan’s trophy office market, the iconic 590 Madison Avenue – long known as the IBM Building – has been put up for sale with an ambitious $1.1 billion price tag. The State Teachers Retirement System of Ohio, which acquired full ownership of the property in 2015 after initially purchasing it with Edward J. Minskoff Equities in 1994, has enlisted Eastdil Secured to market the prestigious asset.

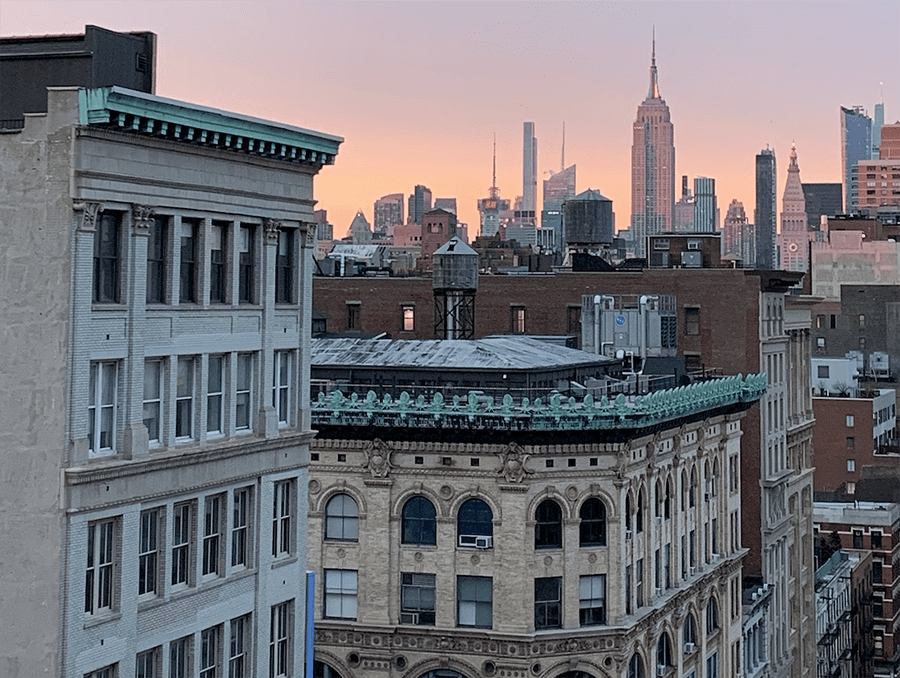

The 41-story, 1-million-square-foot Midtown tower represents the first potential billion-dollar investment sale in New York City in two years. The timing is particularly significant as it coincides with a reinvigorated retail leasing landscape across key Manhattan corridors, according to the latest Real Estate Board of New York (REBNY) report.

This is a watershed moment for Manhattan commercial real estate. The IBM Building sale will be closely watched as a barometer for how investors truly value premium Manhattan assets in the post-pandemic landscape.

While IBM itself has relocated to SL Green’s One Madison Avenue development, the property at 590 Madison continues to attract blue-chip tenants. Luxury conglomerate LVMH recently secured 150,000 square feet across four office floors at an impressive asking rent of $190 per square foot, with potential plans to expand into the building’s retail space.

Other notable tenants include Reverence Capital Partners, E.F. Hutton, and Crestview Partners. Edward J. Minskoff Equities, which continues to manage the property, is transforming IBM’s former client-facing space into premium amenities available to all tenants.

Madison Avenue’s Retail Renaissance

The iconic tower’s sale coincides with a remarkable retail recovery along Madison Avenue, particularly in the luxury corridor between 60th and 76th streets, where storefronts are nearly fully leased with prestigious brands like Giorgio Armani and Van Cleef & Arpels.

“Madison Avenue has maintained its position as one of Manhattan’s most in-demand retail destinations,” notes the REBNY report. The area has benefited from fashion retailers new to the city, including Boggi Milano at 527 Madison, part of a trend that accounted for 20% of major recent leasing deals.

The retail revival extends beyond Madison Avenue, with seven blocks of Bleecker Street in the West Village approaching full occupancy. Rockefeller Center’s retail space is now completely leased, with a new Eataly Cafe expected to open this year.

However, the recovery remains uneven. Despite increased demand, “asking rent in every corridor except Bleecker Street is at least 10% below its pre-pandemic peak,” according to REBNY’s research head Keith DeCoster. Certain areas, including Midtown Third Avenue, Times Square, and Herald Square, continue to face challenges.

IBM’s Strategic Relocation

IBM’s move from its namesake building to One Madison Avenue has helped energize the eastern portion of the Flatiron District. The tech giant’s relocation is part of a broader trend of companies seeking modernized office spaces with state-of-the-art amenities.

IBM’s new home at One Madison represents the evolution of corporate office demands in the post-pandemic era. This shift has created a domino effect of positive retail activity throughout the neighborhood.

All of One Madison’s storefronts are now leased, including to celebrated chef Daniel Boulud’s new La Tete D’or steakhouse, further enhancing the area’s appeal.

The REBNY report identified multiple factors driving Manhattan’s retail resurgence in the latter half of 2024, including a strong jobs market, healthy tourism, and “back-to-office momentum.” These elements have contributed to several large-scale retail deals, including Ikea on Fifth Avenue and Burlington on Sixth Avenue’s Ladies Mile, some spanning up to 80,000 square feet.

As Manhattan’s retail and office landscapes continue their evolution, the pending sale of 590 Madison Avenue stands as a critical test of investor confidence in New York City’s commercial real estate market. Whether the property achieves its ambitious $1.1 billion asking price could set the tone for trophy asset valuations throughout 2025.

–

Looking for premium retail investment opportunities in New York City?

As Manhattan’s commercial real estate market shows signs of recovery with landmark properties changing hands and retail corridors thriving, now is the strategic time to position your portfolio for growth. The real estate specialists at Columbus International offer unparalleled expertise in NYC’s dynamic retail landscape.

Our team of seasoned professionals provides:

- Exclusive access to off-market retail opportunities

- Comprehensive market analysis and valuation services

- Strategic acquisition and disposition guidance

- Expert tenant placement and lease structuring

- Custom investment strategies aligned with your financial goals

Whether you’re interested in Madison Avenue luxury retail, emerging neighborhood corridors, or trophy mixed-use properties, Columbus International delivers personalized service with global perspective.

Contact us today to explore NYC’s most promising retail investment opportunities:

- Email: info@columbusintl.com

- Phone: (+1) 212.327.0160

- Website: www.columbusinternational.com

Columbus International Real Estate – Your Gateway to Premium New York City Investments