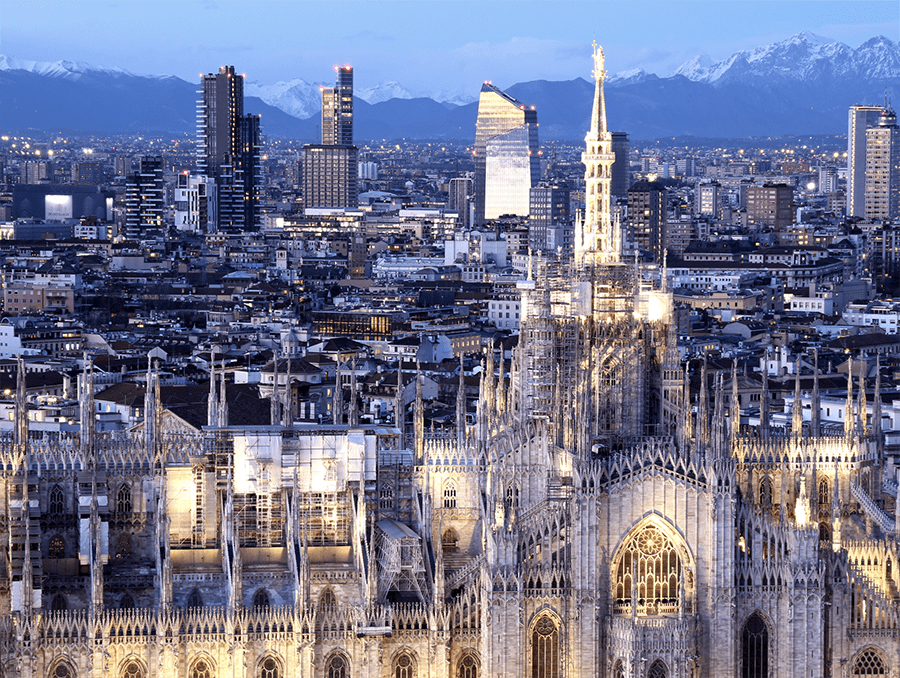

Olympic Effect Triggers Foreign Investment Surge in Italian Real Estate

The 2026 Milan-Cortina Winter Olympics are reshaping Italy's real estate landscape. According to analysis from Gate-away.com, a portal dedicated to foreign buyers seeking Italian properties, international demand has surged substantially…