In a city where branded residences already feature car elevators and fashion house finishing touches, Miami’s latest luxury development is betting on the power of gastronomy to attract ultra-wealthy buyers. Jean-Georges Miami Tropic Residences, the first-ever residential project from legendary Michelin-starred chef Jean-Georges Vongerichten, is set to redefine luxury living through the lens of culinary excellence.

The 48-story architectural masterpiece, rising in Miami’s coveted Design District, represents a bold departure from the automotive and fashion-branded towers that have dominated the city’s luxury real estate landscape. While the Porsche Design Tower made headlines with its innovative sky garages and Dolce & Gabbana’s upcoming project promises haute couture living starting at $3.5 million, Jean-Georges is betting that the way to a luxury buyer’s heart is through their stomach.

“The evolution of branded residences in Miami reflects a deeper understanding of what today’s ultra-high-net-worth individuals truly value,” says Douglas Rill, veteran Florida broker at Century 21 America’s Choice. “It’s no longer just about the name—it’s about the lifestyle experience that name represents.”

A Recipe for Success

The numbers suggest the timing couldn’t be better. Miami-Dade County’s luxury condo market has shown remarkable resilience, with sales of units priced over $1 million surging 122.2% this August compared to 2019 levels. The Jean-Georges project, with prices starting at $1.6 million, enters a market where branded properties command significant premiums.

The development, a collaboration between Terra and Lion Development Group, promises 329 meticulously crafted residences ranging from one to four bedrooms, plus select penthouses. But it’s the 41,000 square feet of amenity spaces that truly set this project apart. The crown jewel? A ground-floor restaurant complex spanning 27,500 square feet, where Vongerichten will blend his various culinary concepts into a singular dining experience.

Beyond the Plate

“This isn’t just about putting a celebrity chef’s name on a building,” explains David Martin, CEO of Terra. “We’re creating an ecosystem where culinary excellence informs every aspect of daily life.” The amenities read like a wish list for the gastronomically inclined: a private dining room with indoor-outdoor flexibility, a chef’s kitchen for resident use, and a sophisticated bar and lounge space.

But perhaps most telling of the project’s ambitions are the unexpected touches: a podcast recording studio, wellness facilities including cold plunges, and even a squash court—suggesting that while food may be the central theme, the development aims to satisfy all aspects of a luxury lifestyle.

The Business of Branded Luxury

The Jean-Georges project joins an increasingly crowded field of branded residences in Miami. Mercedes-Benz, Cipriani, and Aston Martin have all planted their flags in the city’s skyline. Meanwhile, Bentley Residences is under construction in Sunny Isles Beach, with units starting at an eye-watering $5.6 million.

“Not everyone will be able to say they live in a Jean-Georges tower,” notes Juan Arias, CoStar’s director of market analytics. “That exclusivity, combined with the genuine lifestyle integration the brand represents, allows developers to command significant premiums.”

Looking Ahead

With groundbreaking scheduled for summer 2025 and completion targeted for 2027, the Jean-Georges Miami Tropic Residences represents more than just another branded development—it’s a bet on the future of luxury living. As traditional luxury brands continue to enter the real estate market, this culinary-focused approach might just prove to be the secret ingredient Miami’s high-end market has been waiting for.

For Vongerichten himself, who has built an empire of over 60 restaurants globally, including the two-Michelin-starred Jean-Georges in New York, this represents a natural evolution. “This project embodies my vision of combining culinary excellence with lifestyle spaces,” he says. And in Miami’s competitive luxury market, that combination might just be the perfect recipe for success.

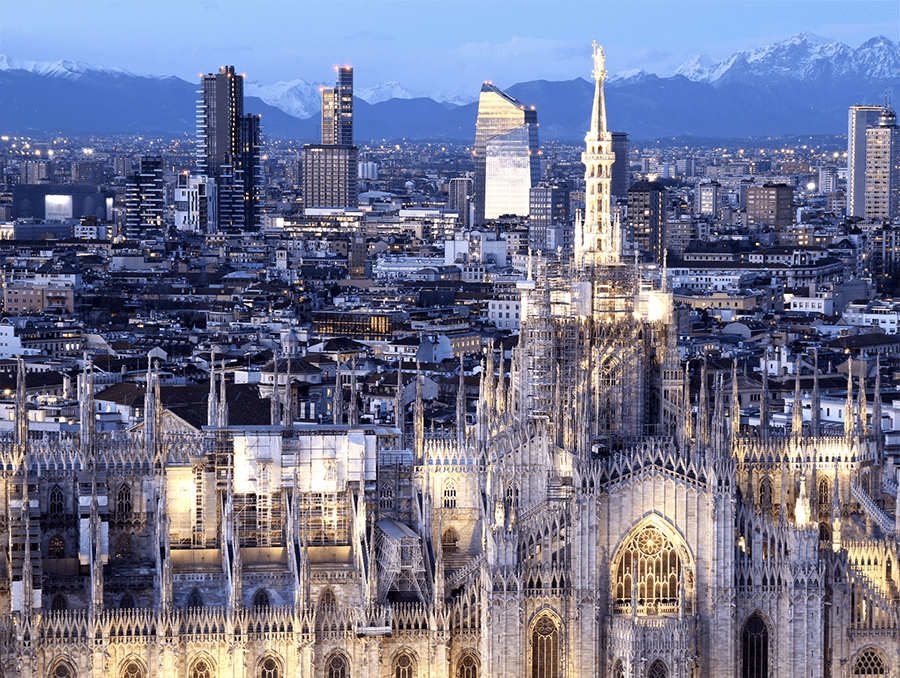

Photo via Miami Tropic Residences