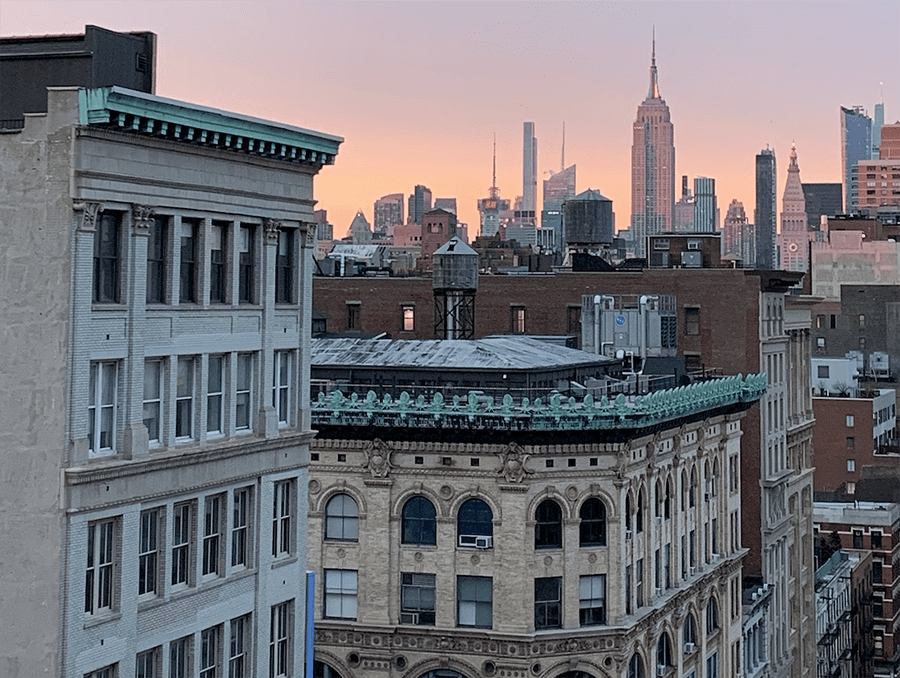

Here are the latest developments in the New York City real estate market.

In the current landscape of the New York City housing market, the equilibrium between buyers and sellers holds significant importance. With a consistent decrease in housing inventory and a rise in median prices, the market tends to favor sellers. The limited availability of homes places sellers in advantageous positions, potentially leading to more favorable deals. However, this doesn’t necessarily translate to a gloomy outlook for buyers. The increased demand and fluctuating market dynamics offer opportunities for those looking to make strategic investments in real estate. The surge in home prices in New York reflects the impact of dwindling housing inventory and heightened demand. Consequently, the prevailing trend indicates that home prices aren’t declining but rather experiencing growth, signaling a robust market with the potential for lucrative returns for sellers.

The year 2024 began much like its predecessor, with low housing inventory and fluctuating interest rates around 6.5 percent, as reported by the New York State Association of REALTORS. The average rate on a 30-year fixed-rate mortgage saw a slight decrease from 6.82 percent in December 2023 to 6.64 percent in January 2024. However, compared to the same period last year, the interest rate has shown an increase from 6.27 percent, highlighting the dynamic nature of the real estate market. One notable shift in the market is the continued decline in housing inventory, persisting for 11 consecutive months in year-over-year comparisons. Across New York, the inventory of homes for sale decreased by 10.2 percent, dropping from 39,544 homes in 2023 to 35,492 units in 2024. This limited supply presents challenges for buyers but also creates an environment where sellers may find opportunities to capitalize on the scarcity of available homes. New listings experienced a modest decline of 1.5 percent, totaling 9,279 in January 2024 compared to 9,423 in the same month of the previous year. Closed sales witnessed a more significant decrease, dropping by 3.8 percent from 7,486 to 7,203 homes in January 2024. Conversely, pending sales increased by 8.9 percent, indicating a potential rebound and heightened activity in the coming months. January saw a 6.7% increase in the number of homes entering into contracts, marking a positive turn as buyers returned amidst declining mortgage rates. This surge, slightly higher than the average over the past five years, is attributed to the drop in mortgage rates during November and December, enticing buyers back into the market post-year-end holidays. However, despite this uptick, challenges remain. Highly-priced homes are staying on the market for longer periods, keeping the city’s median asking price elevated.

Elevated asking prices, coupled with rising mortgage rates, are prompting sellers to make concessions to attract buyers, illustrating a nuanced market scenario. As of January, the median asking price in NYC stood at $1.095 million, reflecting an 11.7% increase from a year ago. This uptick is largely due to a slowdown in the luxury market, where homes priced at $4.975 million and above are taking longer to sell. The median asking price in Manhattan rose by 8.4% year-over-year to $1.68 million, indicating a resilient market experiencing notable shifts. While luxury listings in Manhattan witnessed an increase in median asking prices, the typical luxury listing received only 93.2% of its initial asking price, indicating a shift in power from sellers to buyers at the highest end of the market. In Brooklyn, where inventory is limited, the median asking price surged by 16.8% to $1.05 million. Meanwhile, Queens offers a more affordable option, with a 4.2% year-over-year increase, resulting in a median asking price of $624,900. The NYC housing market grapples with the aftermath of elevated mortgage rates and median asking prices, limiting the pool of potential buyers. While the monthly mortgage payment on a median-priced home rose by 16.1% year-over-year to $5,619 in January, the median asking rent increased by just 0.1% to $3,500. With a considerable number of potential buyers still on the sidelines, those who can afford to stay in the market now have more room for negotiation. The median asking price for homes entering into contracts in January was $925,000, 15.5% lower than the overall median asking price of homes on the market. This disparity indicates a market where more affordable homes are gaining traction among buyers, while the luxury segment experiences a slowdown. Despite the recent decline in mortgage rates, the outlook for the New York City housing market remains complex. Seller concessions, aimed at attracting buyers, have become more prevalent. In September 2023, when mortgage rates were above 7%, 2.7% of for-sale listings mentioned seller concessions. Despite a subsequent decline in average mortgage rates to 6.7%, concessions in January held steady at 2.3%, showcasing a significant increase from the 1.4% average in 2021.

Regarding negotiations, buyers are finding more areas to maneuver. NYC sellers are increasingly willing to offer concessions explicitly in their listings, helping to reduce closing costs for buyers without reducing the asking price. One notable concession gaining popularity is the rate buydown, with 1.7% of sponsor condos offering this option in January, a significant increase from the 0.1% average in 2021.