Atelier Jolie: A Revolutionary Fashion Space Where Sustainability Meets Craftsmanship

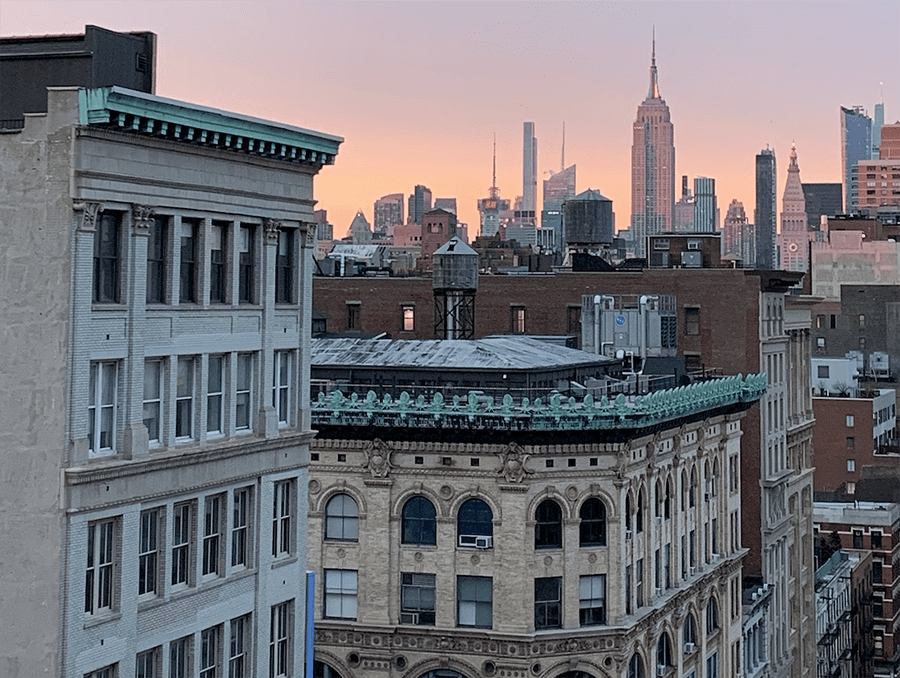

In the heart of New York City's SoHo district, at 57 Great Jones Street – once Jean-Michel Basquiat's studio – Angelina Jolie has launched a groundbreaking fashion venture that challenges…