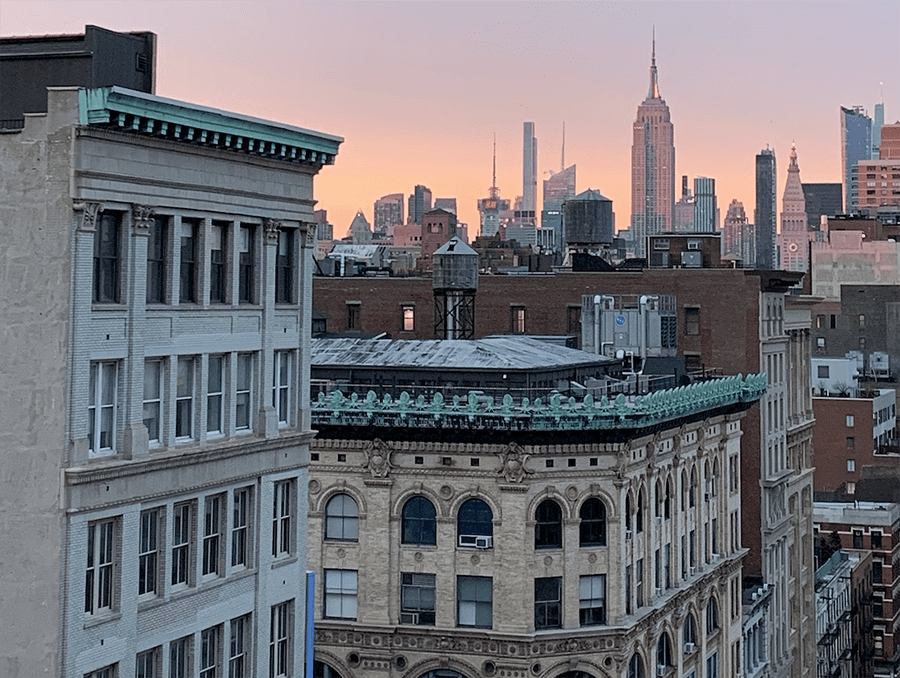

Hugh Jackman And Estranged Wife Begin Asset Division With $24 Million Manhattan Penthouse Split

The high-profile divorce between the Wolverine star and Deborra-Lee Furness offers first glimpse into how celebrity couples navigate luxury real estate portfolios The dissolution of Hollywood marriages rarely unfolds quietly,…