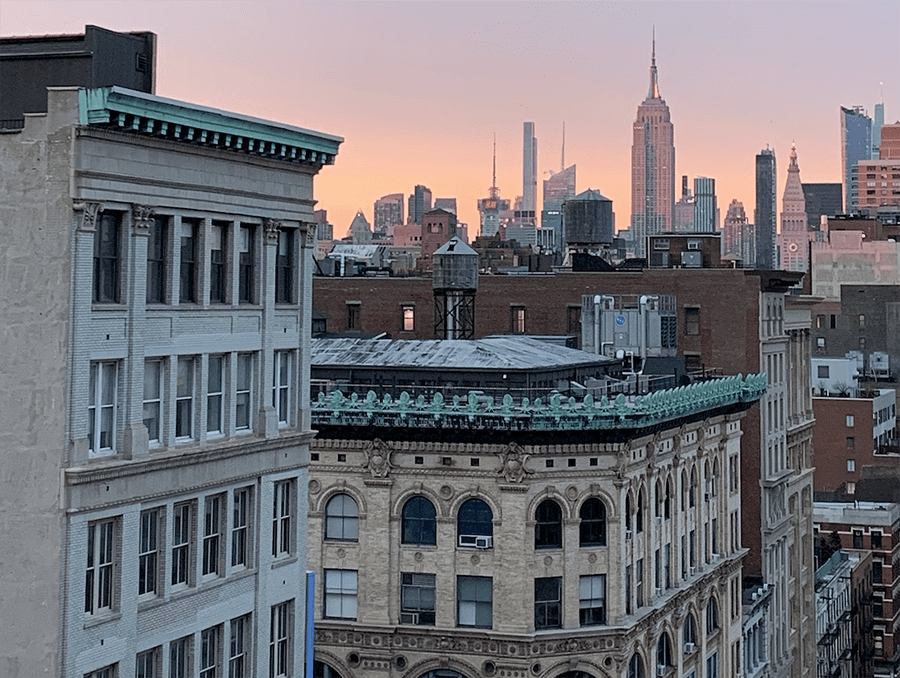

Related Companies Reveals Renderings of Massive $12 Billion NYC Casino Complex at Hudson Yards

Plans have been revealed by Wynn Resorts for a colossal $12 billion project in Hudson Yards, a once train-filled area in Manhattan's West Side. The proposal, crafted in collaboration with…