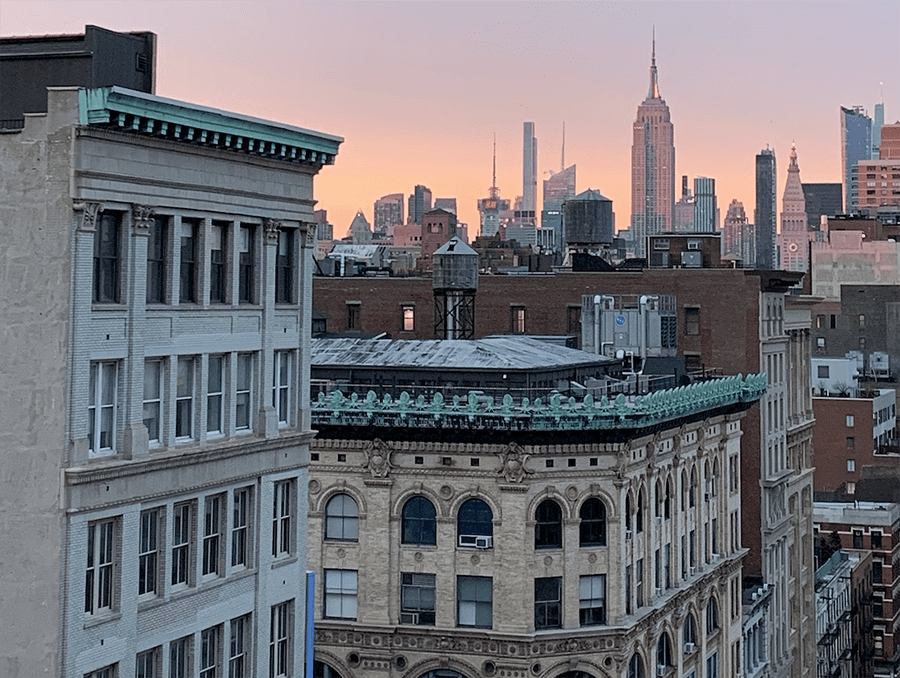

New York City Council Passes Landmark Law Shifting Broker Fees from Tenants to Landlords

The New York City Council passed groundbreaking legislation Wednesday requiring landlords, not tenants, to pay real estate broker fees. The Fairness in Apartment Rental Expenses (F.A.R.E.) Act passed with a…